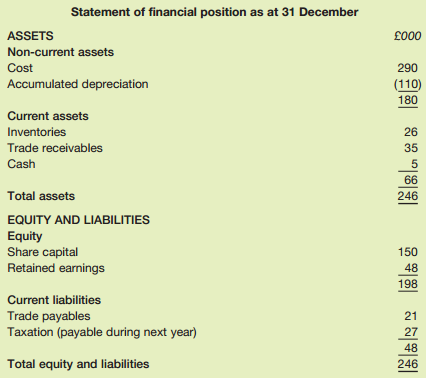

The following is the statement of financial position (in abbreviated form) of Projections Ltd as at the

Question:

The following plans have been made for next year:

1 Revenue is expected to total £350,000, all on credit. Sales will be made at a steady rate over the year and two months€™ credit will be allowed to customers.

2 £200,000 worth of inventories will be bought during the year, all on credit. Purchases will be made at a steady rate over the year and suppliers will allow one month€™s credit.

3 New non-current assets will be bought, and paid for, during the year at a cost of £30,000. No disposals of non-current assets are planned. The depreciation expense for the year will be 10 per cent of the cost of the non-current assets owned at the end of the year.

4 Inventories at the end of the year are expected to have a value double that which applied at the beginning of the year.

5 Operating expenses, other than depreciation, are expected to total £52,000, of which £5,000 will remain unpaid at the end of the year.

6 During the year, the tax noted in the start of the year statement of financial position will be paid.

7 The tax rate can be assumed to be 25 per cent of operating profit. The tax will not be paid during the year.

8 A dividend of £10,000 will be paid during the year.

Required:

Prepare a projected income statement for next year and a statement of financial position as at the end of next year, to the nearest £1,000.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781405888219

5th Edition

Authors: Dr Peter Atrill, Eddie Mclaney, Sin Autor