The income statement below was prepared by a new and inexperienced employee in the accounting department of

Question:

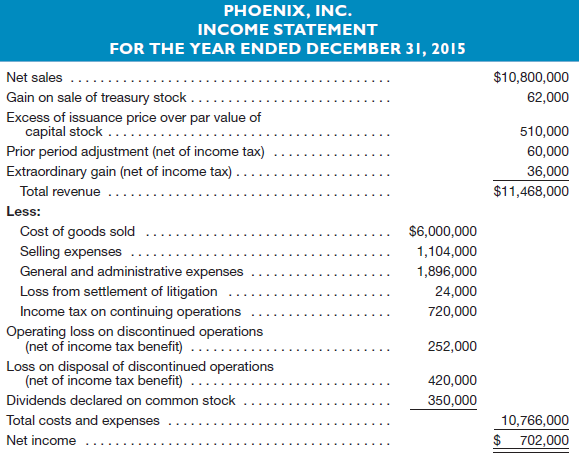

The income statement below was prepared by a new and inexperienced employee in the accounting department of Phoenix, Inc., a business organized as a corporation.

Instructions

a. Prepare a corrected income statement for the year ended December 31, 2015, using the format illustrated in Exhibit 12–2. Include at the bottom of your income statement all appropriate earnings-per-share figures. Assume that throughout the year the company had outstanding a weighted average of 180,000 shares of a single class of capital stock.

b. Prepare a statement of retained earnings for 2015. (As originally reported, retained earnings at December 31, 2014, amounted to $2,175,000.)

c. What does the $62,000 “gain on sale of treasury stock” represent? How would you report this item in Phoenix’s financial statements at December 31, 2015?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0077862381

16th edition

Authors: Jan Williams, Susan Haka, Mark S Bettner, Joseph V Carcello