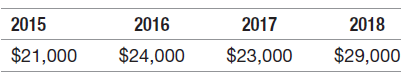

The net income amounts for Hauser and Bradley over the four-year period beginning in 2015 follow. After

Question:

After further examination of the financial report, you note that Hauser and Bradley made accounting method changes in 2016 and 2018, which affected net income in those periods. In 2016, the company changed depreciation methods. This change increased the book value of its fixed assets in each subsequent year by $5,000. In 2018, the company adopted a new inventory method that increased the book value of the inventory by $9,000.

a. Calculate the effect of each of these changes on net income in the year of the change.

b. Prepare a chart that compares net income across the four-year period, assuming that Hauser and Bradley made no accounting changes. How would your assessment of the company€™s performance change after you learned of the accounting method changes?

c. What principle of financial accounting makes it difficult to make such changes? Describe the conditions under which Hauser and Bradley would be allowed to make changes in their accounting methods.

Step by Step Answer: