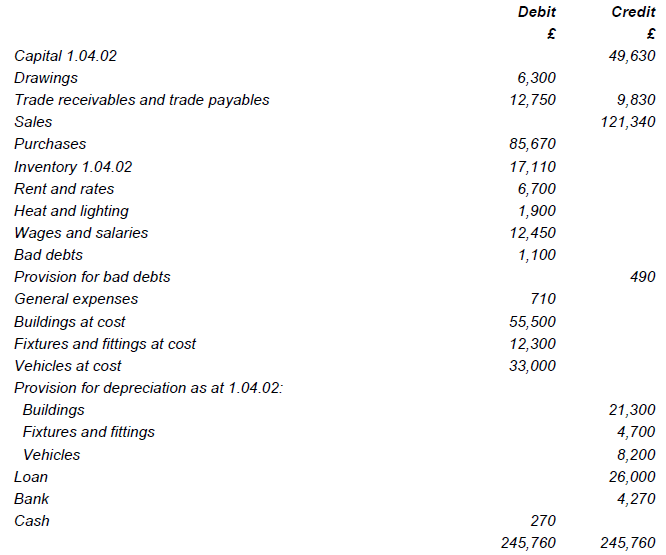

The trial balance for Sharmar for the period ended 31.03.03 before making year-end adjustments is as follows:

Question:

The following matters have not been taken into account when preparing the above trial balance:

1. Closing inventory at 31.03.03 is valued at £15,990.

2. Heat and lighting due 31.03.03 is £230.

3. Rent paid in advance on 31.03.03 is £1500.

4. Depreciation is to be provided as follows:

5. Premises 3% on cost.

6. Fixtures and fittings 12.5% on cost.

7. Vehicles 20% reducing balance.

8. A further bad debt of £785 is to be written off and the provision for bad debts is to be at 4%

of trade receivables after write-offs.

9. The interest on the loan is 7.5% per annum and this has not been paid for the year.

Required:

Prepare an income statement for the period ended and a statement of financial position as at 31.03.03.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: