This case is in continuation of Mini Case 2.6 of Chapter 2, on Ram Traders Limited and

Question:

This case is in continuation of Mini Case 2.6 of Chapter 2, on Ram Traders Limited and his chilli business. The problem has a few transactions mentioned for a complete month. Assume a corporate income tax rate of 35% and prepare an income statement of the organization.

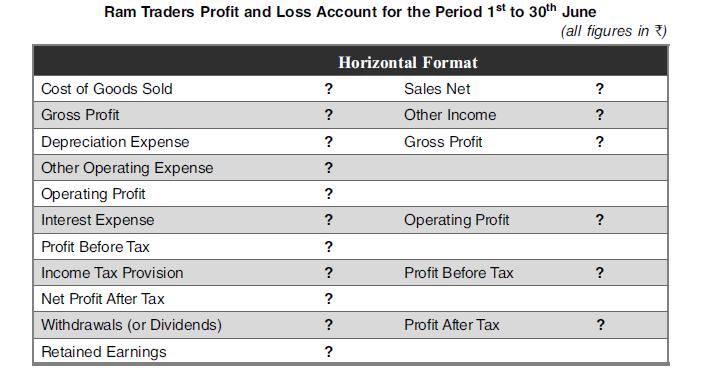

Please fill the below table:

Data from Mini Case 2.6 of Chapter 2

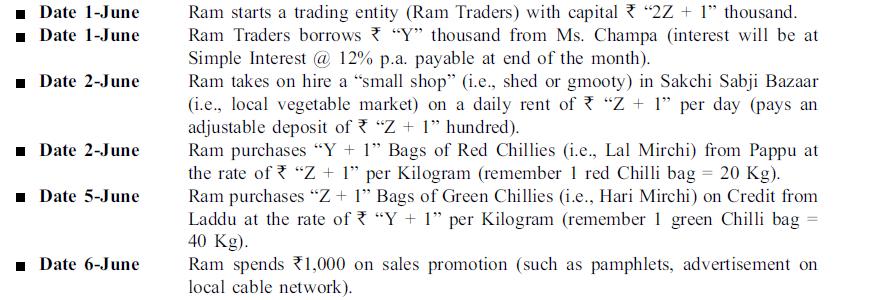

Ram decides to start a business in the local vegetable market of Jamshedpur. The case below is completely based on your roll number (Z being the last three digits of your roll number) and day of birth (Y) as per your records.

- Example 1: If your roll number is FB15008 and Date of Birth is 22-Jun-1748 then Z will be ‘008’ and Y will be ‘22’.

- Example 2: If your roll number is O15023 and Date of Birth is 29-Feb.-2008 then Z will be ‘023’ and Y will be ‘29’.

- Example 3: If your roll number is BM15209 and Date of Birth is 01-Dec-1899 then Z will be ‘209’ and Y will be ‘01’.

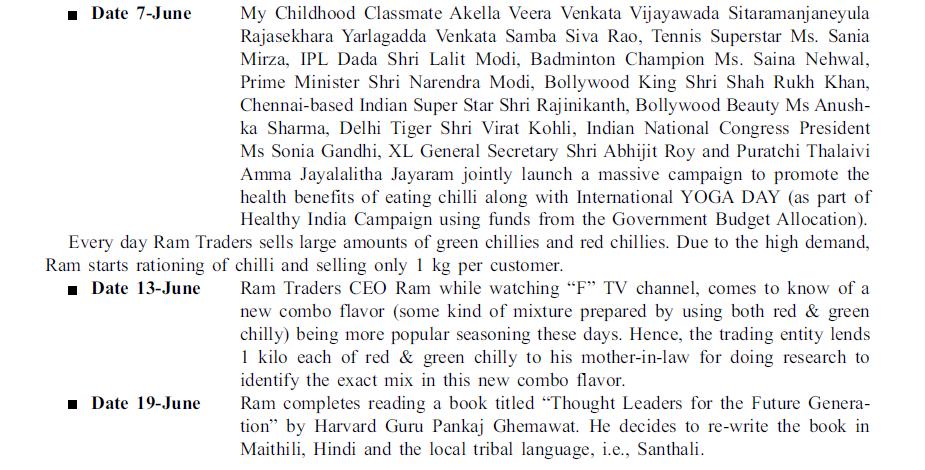

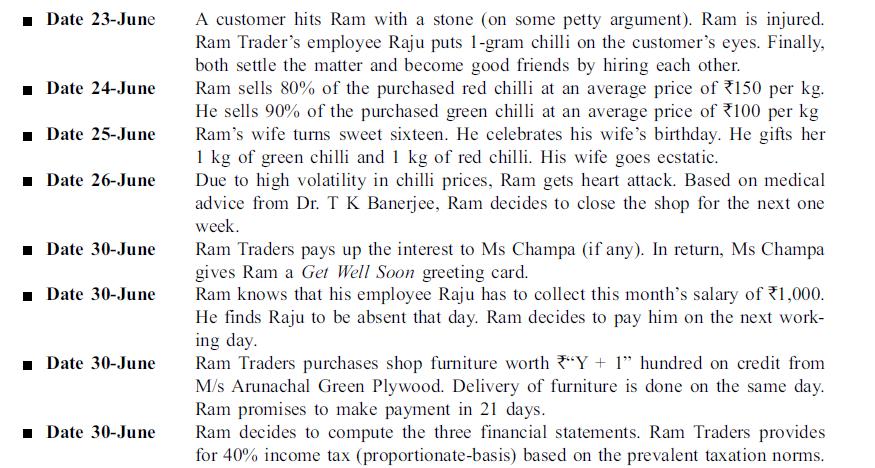

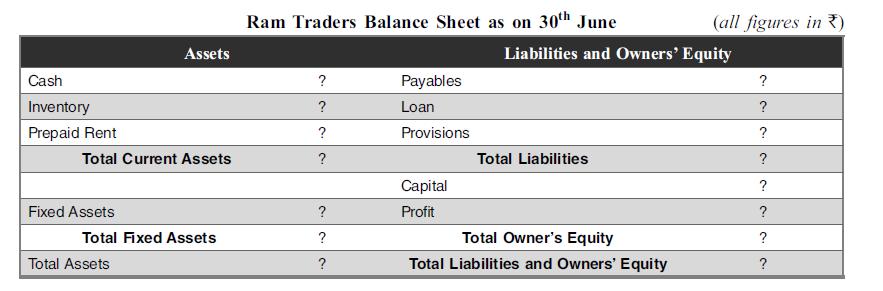

We provide the transactions and events against each date for Ram Traders below. You are required to prepare the position statement of the organization.

Based on the details above, please prepare the financial position as on 30th June. Please fill the table below.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani