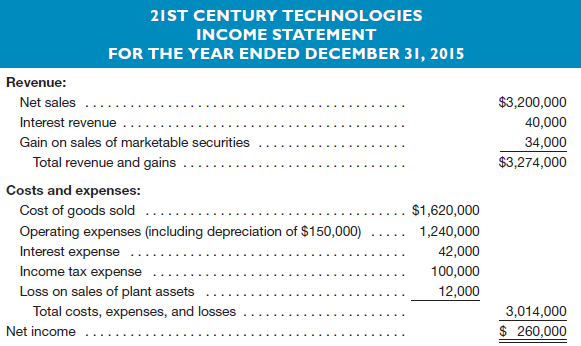

You are the controller for 21st Century Technologies. Your staff has prepared an income statement for the

Question:

You are the controller for 21st Century Technologies. Your staff has prepared an income statement for the current year and has developed the following additional information by analyzing changes in the company’s balance sheet accounts.

Additional Information

1. Accounts receivable increased by $60,000.

2. Accrued interest receivable decreased by $2,000.

3. Inventory decreased by $60,000, and accounts payable to suppliers of merchandise decreased by $16,000.

4. Short-term prepayments of operating expenses increased by $6,000, and accrued liabilities for operating expenses decreased by $8,000.

5. The liability for accrued interest payable increased by $4,000 during the year.

6. The liability for accrued income taxes payable decreased by $14,000 during the year.

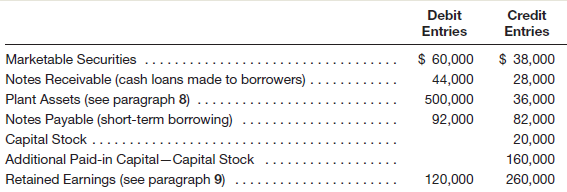

7. The following schedule summarizes the total debit and credit entries during the year in other balance sheet accounts:

8. The $36,000 in credit entries to the Plant Assets account is net of any debits to Accumulated Depreciation when plant assets were retired. Thus, the $36,000 in credit entries represents the book value of all plant assets sold or retired during the year.

9. The $120,000 debit to Retained Earnings represents dividends declared and paid during the year. The $260,000 credit entry represents the net income shown in the income statement.

10. All investing and financing activities were cash transactions.

11. Cash and cash equivalents amounted to $244,000 at the beginning of the year and to $164,000 at year-end.

Instructions

a. Prepare a statement of cash flows for the current year. Use the direct method of reporting cash flows from operating activities. Place brackets around dollar amounts representing cash outflows.

Show separately your computations of the following amounts:

1. Cash received from customers.

2. Interest received.

3. Cash paid to suppliers and employees.

4. Interest paid.

5. Income taxes paid.

6. Proceeds from sales of marketable securities.

7. Proceeds from sales of plant assets.

8. Proceeds from issuing capital stock.

b. Explain the primary reason why:

1. The amount of cash provided by operating activities was substantially greater than the company’s net income.

2. There was a net decrease in cash over the year, despite the substantial amount of cash provided by operating activities.

c. As 21st Century’s controller, you think that through more efficient cash management, the company could have held the increase in accounts receivable for the year to $10,000, without affecting net income. Explain how holding down the growth in receivables affects cash. Compute the effect that limiting the growth in receivables to $10,000 would have had on the company’s net increase or decrease in cash (and cash equivalents) for the year.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0077862381

16th edition

Authors: Jan Williams, Susan Haka, Mark S Bettner, Joseph V Carcello