You were recently offered a position as an intern in the accounting firm Faitou and Dowal LLP.

Question:

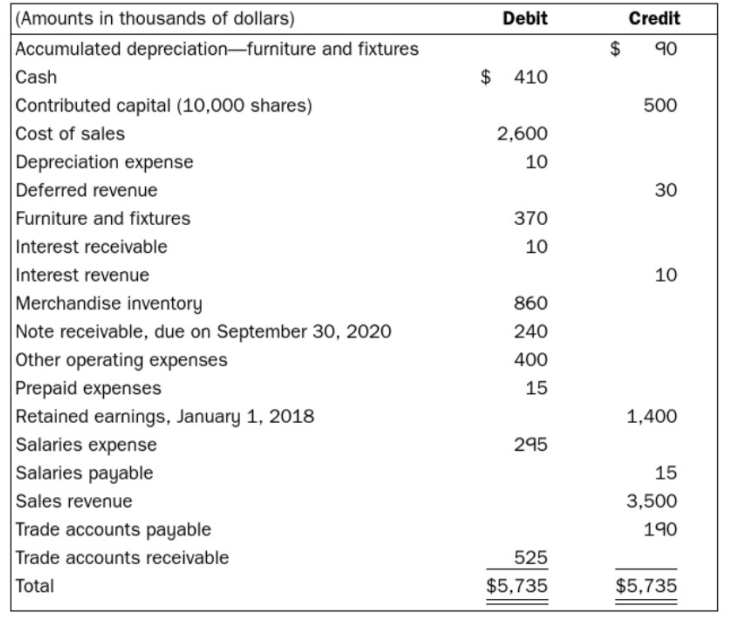

You were recently offered a position as an intern in the accounting firm Faitou and Dowal LLP. On yow?first day at work, yow?supervisor wanted to test your knowledge of accounting. She gave you the following list of accounts and related balances of New Look Corp. as at December 31, 2018, and asked you to complete the requirements below

Required:1. Prepare the statement of earnings for New Look Corp. for the year ended December 31, 2018. The company is subject to an income tax rate of 40 percent and pays its income taxes within three months.2. By how much would net earnings change if depreciation expense was omitted in the preparation of the statement of earnings?3. Prepare the liabilities and shareholders' equity sections of a classified statement of financial position for New Look Corp. as at December 31, 2018.4. Compute the total asset turnover ratio and the return on assets based on your answers to the previous requirement, and explain the meaning of each ratio. Assume that the company reported total assets of $2,150 at December 31, 2017.

Asset TurnoverAsset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Financial Accounting

ISBN: 978-1259105692

6th Canadian edition

Authors: Robert Libby, Patricia Libby, Daniel G Short, George Kanaan, Maureen Sterling