Andres is taxed at a 17% tax rate for his federal taxes. Last year, he reduced his

Question:

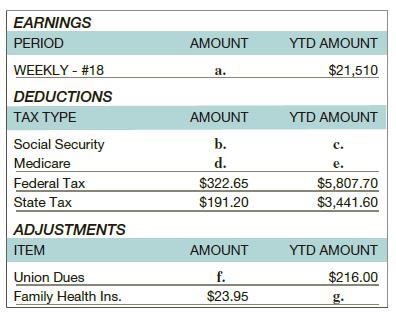

Andres is taxed at a 17% tax rate for his federal taxes. Last year, he reduced his taxable income by contributing $350 per biweekly paycheck to his tax-deferred retirement account and $50 per biweekly paycheck to his FSA. How much did he reduce his annual federal taxes by if his gross biweekly pay is $1,870?

Transcribed Image Text:

EARNINGS PERIOD WEEKLY - #18 DEDUCTIONS TAX TYPE Social Security Medicare Federal Tax State Tax ADJUSTMENTS ITEM Union Dues Family Health Ins. AMOUNT a. AMOUNT b. d. $322.65 $191.20 AMOUNT f. $23.95 YTD AMOUNT $21,510 YTD AMOUNT C. e. $5,807.70 $3,441.60 YTD AMOUNT $216.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Amount he reduce his annua...View the full answer

Answered By

Willis Omondi

Hi, I'm Willis Omondi, a proficient and professional academic writer. I have been providing high-quality content that best suits my clients and completing their work within the deadline. All my work has been 100% plagiarism-free, according to research from my services, especially in arts subjects and many others

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted:

Students also viewed these Mathematics questions

-

Because income from fixed income assets is taxed at a higher income tax rate than capital gains and dividends from equities, there is no reason that one would have fixed income assets in a taxable...

-

Martina is taxed at a rate of 25% for her federal taxes. Last year, she reduced her taxable income by contributing to a flexible savings plan in the amount of $2,700. If her wages before the...

-

How much federal income tax should Aman report if she earned taxable income of $32 920 and $17 700 from her two jobs? Use the 2012 federal income tax brackets and rates in Table 3.3 to answer the...

-

Listed below is the income statement for Tom and Sue Travels, Incorporated. TOM AND SUE TRAVELS, INCORPORATED Income Statement for Year End ( in millions of dollars ) Net sales $ 1 9 . 6 0 0 Less:...

-

The Northwest Pacific Phone Company wishes to estimate the average number of minutes its customers spend on long-distance calls per month. The company wants the estimate made with 99% confidence and...

-

The auditor is planning for the audit of a specialty retail store. Inventory is material, and items range in value from $1 to over $500. The nature of the store means that the type of merchandise...

-

9-7. Cul es la diferencia entre sinergias de marketing y sinergias de productos en una matriz mercado-producto ?

-

The income statement of Hauser Company is presented on the shown below.? Additional information: 1. Accounts receivable decreased $290,000 during the year, and inventory increased $140,000. 2....

-

ROMY HIRUHILIPPONIMIA Four brothers organized Beverly Entertainment Enterprises on October 1, 2012. The following transactions occurred during the first month of operations: October 1: Received...

-

Use Starbucks balance sheet dated 10/02/2011 (on the opposite page) to answer the following questions. a. How much do customers owe this company? ___________ million b. For inventories, $965.8...

-

Use Tax Schedule Y-1 from Example 1 and Exercises 5 and 6. Select any income. Write an equation for that income for the three different years. Data From Exercise 6 Use the 2012 Schedule Y-1 for a...

-

For what taxable income would a taxpayer have to pay $26,277.50 in taxes? Explain your reasoning. Schedule Z-If your filing status is Head of household If your taxable income is: Over- $0 13,150...

-

A building has a total load of 150 kVA and a power factor of 0.85 (lagging). Among the electrical load, there is a 40 HP, three-phase, 60 Hz, 480 V induction motor with an efficiency of 0.92 and a...

-

Your friend Amber has approached you seeking advice concerning two investment opportunities that she is presently considering. Her classmate Simone has asked her for a loan of $5,000 to help...

-

Please read the following carefully. For each question on the exam, you should assume that: 1. unless expressly stated to the contrary, all events occurred in ?the current taxable year;? 2. all...

-

The pulse rates of 152 randomly selected adult males vary from a low of 37 bpm to a high of 117 bpm. Find the minimum sample size required to estimate the mean pulse rate of adult males. Assume that...

-

Can I get clear explanation how to work these. Thanking you in advance. 1. A rod 12.0 cm long is uniformly charged and has a total charge of -23.0 uC. Determine the magnitude and direction of the...

-

Poll Results in the Media USA Today provided results from a survey of 1144 Americans who were asked if they approve of Brett Kavanaugh as the choice for Supreme Court justice. 51% of the respondents...

-

Sketch the graph of a function that satisfies the given conditions. f(0) = 0, f is continuous and even, f'(x) = 2x if 0 3

-

Reread the discussion leading to the result given in (7). Does the matrix sI - A always have an inverse? Discuss.

-

Select the third point from each of the six samples, and compute the sample sd from the collection of six third points? Table 6.2: Sample of birth-weights (oz) obtained from 1000 consecutive...

-

What theoretical relationship should there be between the standard deviation in Problem 6.48 and the standard deviation in Problem 6.49? Table 6.2: Sample of birth-weights (oz) obtained from 1000...

-

How do the actual sample results in Problems 6.48 and 6.49 compare? Obstetrics Figure 6.4b (p. 172) plotted the sampling distribution of the mean from 200 samples of size 5 from the population of...

-

A company is evaluating a new 4-year project. The equipment necessary for the project will cost $3,300,000 and can be sold for $650,000 at the end of the project. The asset is in the 5-year MACRS...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

I need to see where the calculations for this problem come from plz. 5. Award: 4.00 points Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement...

Study smarter with the SolutionInn App