Calculate the tax for each taxable income of a head of household. a. $400,000 b. $10,954 c.

Question:

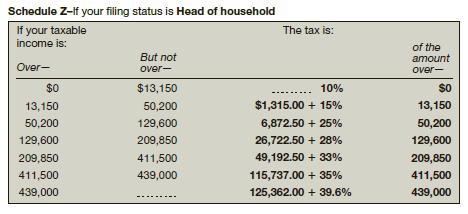

Calculate the tax for each taxable income of a head of household.

a. $400,000

b. $10,954

c. $108,962

d. $209,850

Transcribed Image Text:

Schedule Z-If your filing status is Head of household If your taxable income is: Over- $0 13,150 50,200 129,600 209,850 411,500 439,000 But not over- $13,150 50,200 129,600 209,850 411,500 439,000 The tax is: 10% $1,315.00+ 15% 6,872.50 + 25% 26,722.50 +28% 49,192.50 +33% 115,737.00 + 35% 125,362.00+ 39.6% of the amount over- $0 13,150 50,200 129,600 209,850 411,500 439,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

ANSWER Using Schedule Z for Head of Household we can calculate the tax for each taxable income as fo...View the full answer

Answered By

Akash M Rathod

I have been utilized by educators and students alike to provide individualized assistance with everything from grammar and vocabulary to complex problem-solving in various academic subjects. I can provide explanations, examples, and practice exercises tailored to each student's individual needs, helping them to grasp difficult concepts and improve their skills.

My tutoring sessions are interactive and engaging, utilizing a variety of tools and resources to keep learners motivated and focused. Whether a student needs help with homework, test preparation, or simply wants to improve their skills in a particular subject area, I am equipped to provide the support and guidance they need to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted:

Students also viewed these Mathematics questions

-

Determine the tax for each filing status and taxable income amount. a. Single $57,723 b. Head of household $60,950 c. Married filing jointly $63,999 d. Married filing separately $57,521 If line 43...

-

Determine the tax for each filing status and taxable income amount listed using the tax tables in the Appendix. a. Single $97,642 b. Head of household $95,100 c. Married filing jointly $99,999 d....

-

Determine the tax for each filing status and taxable income amount listed using the tax tables in the Appendix, or using the current tables at www.irs.gov, depending on what your teacher requires. a....

-

A certain apple bruises if a net force greater than 9 . 5 N is exerted on it . Would a 0 . 1 3 k g apple be likely to bruise if it falls 1 . 8 m and stops after sinking 0 . 0 5 m into the grass?...

-

A decision maker is interested in estimating the mean of a population based on a random sample. She wants the confidence level to be 90% and the margin of error to be 0.30. She does not know what...

-

Detective controls do not include: (a) Management level reviews. (b) Performance indicators. (c) Account coding. (d) Reconciliations.

-

2 Qu variables se usaran para segmentar estos mercados industriales?: a) barredoras industriales, b) fotocopiadoras, c) sistemas de control de produccin computarizados, d) agencias de renta de...

-

Benedict Company leased equipment to Mark Inc. on January 1, 2017. The lease is for an eight-year period, expiring December 31, 2024. The first of eight equal annual payments of $600,000 was made on...

-

Jones Corporation's capital structure follows. December 31 2020 Outstanding shares of stock Common stock, outstanding shares. Convertible preferred stock, outstanding shares 8% Convertible bonds...

-

Its critical that you understand all the factors that make a customer a good candidate to buy your product. Pick one of the following products to conduct your own analysis. Louis Vuitton Bag Planet...

-

Use the 2012 Schedule Y-1 for a married taxpayer filing jointly. Write the piecewise function for the tax intervals. 2012 Tax Rate Schedule Schedule Y-1-If your filing status is Married filling...

-

Mr. and Mrs. Delta are filing a joint tax return. Together they had an income of $100,830 last year. Their total deductions were $16,848. a. What was Mr. and Mrs. Deltas taxable income? b. What is...

-

Which of the following statements is incorrect? (a) In a company liquidation preference shares are entitled to priority return of capital (b) Normally preference shares have no votes at meetings of...

-

The waiting times between a subway departure schedule and the arrival of a passenger are uniformly distributed between 0 and 9 minutes. Find the probability that a randomly selected passenger has a...

-

Greenview Dairies produces a line of organic yogurts for sale at supermarkets and specialty markets in the Southeast. Economic conditions and changing tastes have resulted in slowing demand growth....

-

Rudy Gandolfi owns and operates Rudy's Furniture Emporium Inc. The balance sheet totals for assets, liabilities, and stockholders' equity at August 1, 2019, are as indicated. Described here are...

-

If you were team leader how would you break up this assignment for 4 people to complete? Group Case Analysis Parts 4, 5, and 6 IV. STRATEGY IMPLEMENTATION. (How are you going to do what you want to...

-

A genetic experiment with peas resulted in one sample of offspring that consisted of 440 green peas and 166 yellow peas. Construct a 90% confidence interval to estimate of the percentage of yellow...

-

Find, correct to two decimal places, the coordinates of the point on the curve y = sin x that is closest to the point (4, 2).

-

Write a while loop that uses an explicit iterator to accomplish the same thing as Exercise 7.3. Exercise 7.3. Write a for-each loop that calls the addInterest method on each BankAccount object in a...

-

Compare results from the two methods and comment on whether the large sample method is appropriate for these nutrients?

-

Compute the large sample and bootstrap 95% CI for mean calorie-adjusted total fat and saturated fat? One issue is that people with higher total caloric intake generally have higher intakes of...

-

Answer the question in Problem 6.61 for calorie-adjusted total fat and calorie-adjusted saturated fat? One issue is that people with higher total caloric intake generally have higher intakes of...

-

Mass LLp developed software that helps farmers to plow their fiels in a mannyue sthat precvents erosion and maimizes the effoctiveness of irrigation. Suny dale paid a licesnsing fee of $23000 for a...

-

Average Rate of Return The following data are accumulated by Lone Peak Inc. in evaluating two competing capital investment proposals: 3D Printer Truck Amount of investment $40,000 $50,000 Useful life...

-

4. (10 points) Valuation using Income Approach An appraiser appraises a food court and lounge and provides the following assessment: o O The building consists of 2 floors with the following (6)...

Study smarter with the SolutionInn App