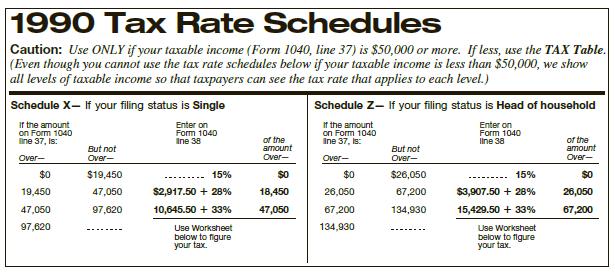

In 1990, taxpayers used the following tax schedule. a. Compare the tax of a head of household

Question:

In 1990, taxpayers used the following tax schedule.

a. Compare the tax of a head of household whose taxable income in 1990 was $120,000 with the tax of a head of household who earns the same amount using the tax schedule from Exercise 6.

b. What percent of the taxable income was the tax in each case?

c. Go to the IRS website (www.irs.gov) and find the most recent tax rate schedules. Compare the tax of the same head-of-household taxpayer from part a with a head-of-household taxpayer with the same taxable income today. What percent increase has there been in the tax?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted: