Many people claim that once they are married, they pay more taxes than they did before they

Question:

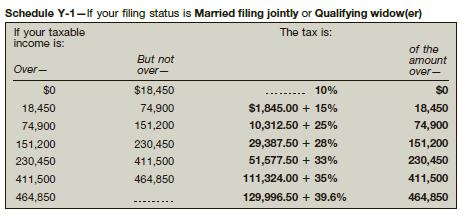

Many people claim that once they are married, they pay more taxes than they did before they were married. Many call this a marriage penalty. Suppose that Leni and Thom are lawyers and each has a taxable income of $230,000. They can’t decide if they should be married in December or in January. If they marry in December, then they are considered married for the entire tax year and could file a joint return. If they get married in January of the next year, they would file a separate return each as a single taxpayer. Examine Schedules X and Y-1. Which filing status would yield the lower tax and by how much? Is there really a marriage penalty?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted: