When is the payment for this statement due? ACCOUNT INFORMATION Account Number TRANSACTIONS 9 MAY 12 MAY

Question:

When is the payment for this statement due?

Transcribed Image Text:

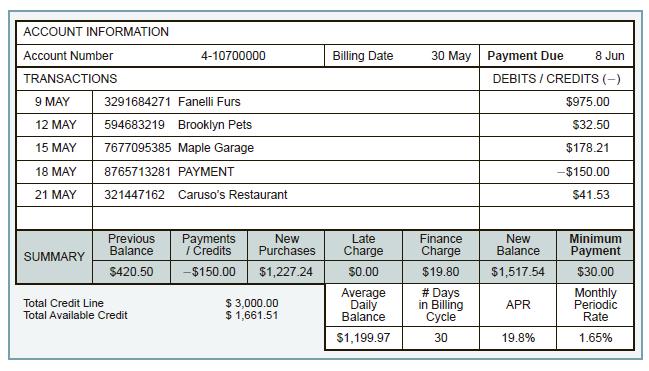

ACCOUNT INFORMATION Account Number TRANSACTIONS 9 MAY 12 MAY 15 MAY 18 MAY 21 MAY SUMMARY 3291684271 Fanelli Furs 594683219 Brooklyn Pets 7677095385 Maple Garage 8765713281 PAYMENT 321447162 Previous Balance $420.50 4-10700000 Total Credit Line Total Available Credit Caruso's Restaurant Payments / Credits -$150.00 New Purchases. $1,227.24 $ 3,000.00 $ 1,661.51 Billing Date Late Charge $0.00 Average Daily Balance $1,199.97 30 May Payment Due Finance Charge $19.80 # Days in Billing Cycle 30 8 Jun DEBITS/CREDITS (-) New Balance $1,517.54 APR 19.8% $975.00 $32.50 $178.21 -$150.00 $41.53 Minimum Payment $30.00 Monthly Periodic Rate 1.65%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

ANSWER Based on the information provided the payment for this statement is due on June 8th EXPLAINAT...View the full answer

Answered By

Chandrasekhar Karri

I have tutored students in accounting at the high school and college levels. I have developed strong teaching methods, which allow me to effectively explain complex accounting concepts to students. Additionally, I am committed to helping students reach their academic goals and providing them with the necessary tools to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted:

Students also viewed these Mathematics questions

-

The scheduled payment stream consists of $5000 due today and $10,000 due in five years. It is proposed to replace this stream by an economically equivalent stream comprised of three equal payments...

-

When a mortgage payment is made, a portion of it is applied to interest, and the balance is applied to reduce the principal. How is the amount applied to reduce the principal computed?

-

This month you made a mortgage payment of $ 700, of which $ 600 was an interest payment and $ 100 a payment of the loan principal. You are in the 25% marginal tax bracket. What is the tax savings as...

-

Deuterium ( ) is an attractive fuel for fusion reactions because it is abundant in the oceans, where about 0.015% of the hydrogen atoms in the water (H 2 O) are deuterium atoms. (a) How many...

-

Explain and carefully describe the following four security positions, drawing payoff diagrams wherever necessary to support your answer: a. Short a forward contract with a delivery price of $100 b....

-

Most vehicles have a radio antenna that is oriented along the vertical direction. Why? Is having an antenna mounted at a slanting angle an advantage or disadvantage? Explain.

-

In exporting, at what point does the risk of loss or damage pass to the buyer? Use Incoterms to explain your response.

-

On April 16, 2014, ColorCo purchased a put option for $800 on Choco common stock. The put option gives ColorCo the option to sell 5,000 shares of Choco at a strike price of $25 per share for a period...

-

Congratulations! As a recent graduate from an MBA program you are a self-employed consultant who specializes in financial analysis. Dollar General Corporation has hired you to assist them to compute...

-

a. On January 1, Lumia Companys liabilities are $60,000 and its equity is $40,000. On January 3, Lumia purchases and installs solar panel assets costing $10,000. For the panels, Lumia pays $4,000...

-

Felix and Oscar applied for the same credit card from the same bank. The bank checked both of their FICO scores. Felix had an excellent credit rating, and Oscar had a poor credit rating. a. Felix was...

-

Charlie and Kathy want to borrow $20,000 to make some home improvements. Their bank will lend them the money for 10 years at an interest rate of 5.75%. How much will they pay in interest?

-

How does a relational database store data?

-

Solve (c) 8 WI n=1 5 cos n N5

-

- Pierce Company reported net income of $160,000 with income tax expense of $19,000 for 2020. Depreciation recorded on buildings and equipment amounted to $80,000 for the year. Balances of the...

-

ABC Company had the following results as of 12/31/2020: ABC's hurdle rate is 10% CONTROLLABLE REVENUE CONTROLLABLE COST CONTROLLABLE ASSETS CONTROLLABLE INCOME 21. What is the division's margin? A....

-

A gray kangaroo can bound across a flat stretch of ground with each jump carrying it 10 m from the takeoff point. If the kangaroo leaves the ground at a 20 angle, what are its (a) takeoff speed and...

-

Since 1900, many new theories in physics have changed the way that physicists view the world. Create a presentation that will explain to middle school students why Quantum Mechanics is important, how...

-

Sketch a graph of a function f that is continuous on (-, ) and has the following properties. f'(x) < 0 and f"(x) > 0 on (-, 0); f'(x) > 0 and f"(x) > 0 on (0, )

-

Derive Eq. (18.33) from Eq. (18.32).

-

According to the Nielsen Company, Americans spend $345 million on chocolate during the week of Valentines Day. Lets assume that we know the average married person spends $45, with a population...

-

Lets assume the average speed of a serve in womens tennis is around 118 mph, with a standard deviation of 12 mph. We recruit 100 amateur tennis players to use our new training method this time, and...

-

As in the previous exercise, assume the average speed of a serve in womens tennis is around 118 mph, with a standard deviation of 12 mph. But now we recruit only 26 amateur tennis players to use our...

-

Revenue Recognition and Sales Allowances accounting purposes ) . The goods are shipped from the warehouse on March 6 , and FedEx confirms delivery on March 7 . Ignore shipping costs, sales tax, and...

-

Ellis Perry is an electronics components manufacturer. Information about the company's two products follows: \ table [ [ , , , ] , [ Units produced,AM - 2 , FM - 9 , ] , [ Direct labor hours required...

-

Which of the following requirements to claim Earned Income Tax Credit is TRUE? The credit can be claimed under any filing status. The taxpayer must have a valid SSN for employment in the U.S., issued...

Study smarter with the SolutionInn App