Fine Metals, Inc., is a wholesaler of precious metals. The company maintains two key product lines: gold

Question:

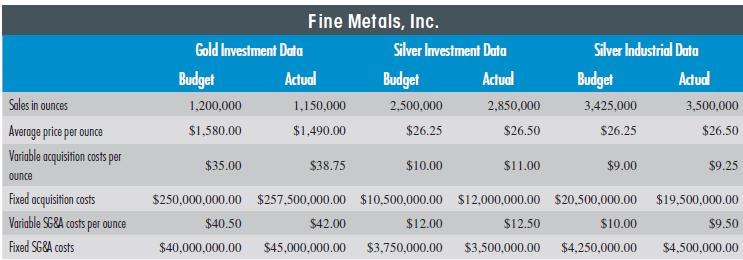

Fine Metals, Inc., is a wholesaler of precious metals. The company maintains two key product lines: gold and silver. The company keeps the metals in both coins and bars and sells to both the investing market and the various industries that use silver in their manufacturing process. Keith Bolton, president of Fine Metals, Inc., has assigned responsibility for sales to three managers, one in charge of gold sales to investors (Joy Barnes), one in charge of silver sales to investors (Pete B lake), and one in charge of industrial sales of silver (Joey Michaels). Each subdivision of the business develops its own budget , which is then “flexed” to develop variances once a sales period has ended. This variance analysis is used to judge the performance of the three managers. The following table contains the key information for the three branches of the business for the latest year. No inventory changes have taken place as the company buys only what it sells in an arbitrage market—it does not really hold any inventory on hand. The results are:

The company does not have enough sales to really influence the trends in the marketplace. Individual managers, however, can be more or less successful at moving their products, using marketing pitches on major television networks and radio programs to move the product into the marketplace. Silver industrial sales are an except ion to this type of marketing. Here, the marketing dollars need to go into trade shows and trade publications, including the buyer’s guides that purchasing agents use when making purchases for their company. It is a very different business from the investing side of the house, facing different types of competition. Market demand is much steadier for industrial sales, also, as companies that make products using silver are fairly large and reliable consumers of the silver ingots. Industrial sales can buy in larger quantities, driving down its acquisition costs as compared to the other two products.

The gold market is volatile, with annual price swings being significant . When economies get in trouble, investors flock to gold, driving the prices up. When economies are stable, then investors tend to put their money in the stock market and gold prices plummet . Again, Fine Metals, Inc., is not a market mover or price setter—it is definitely a price taker. It also takes a lot more marketing to move gold because of its high price per ounce. Where almost any investor can afford to buy silver coins, gold coins are much more difficult for people to acquire. That means the customers demand more and the acquisition costs of moving the gold are much higher than they are for silver.

REQUIRED:

a. Prepare a budgeted vs. actual income statement for each of the business segments.

b. Compute the flexible budget variances for the three segments of Fine Metals’ market. Remember that if cost variances show positive in this analysis, they are actually unfavorable, while revenue variances are unfavorable if they are negative. In other words, if actual sales are less than planned, it will show up as a negative which makes sense as less sales is not good (unfavorable). If actual costs are lower than plan, this will also show up as a negative, but is actually a favorable outcome.

c. Which set of numbers do you feel is a better indicator of segment performance? Why?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant