Mansons Pay roll Service consists of two primary divisionsPay roll Services and Tax Services. The pay roll

Question:

Manson’s Pay roll Service consists of two primary divisions—Pay roll Services and Tax Services.

The pay roll services division does very well, earning on average 18% ROI. Tax services, in the other hand, struggles earning on average only 8.5% ROI.

The company's WACC is 8%. It is year- end, and both divisions are faced with deciding whether or not to invest in new computers and software support systems.

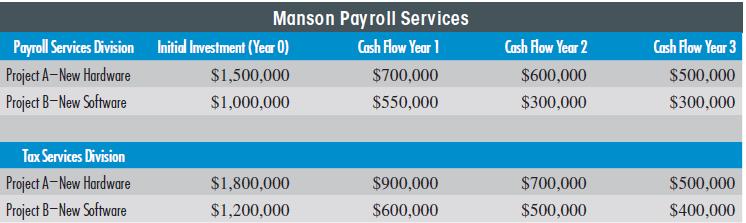

The details of the options that Pay roll Services and Tax Services are looking at are in the following table.

Sam Houston, head of the pay roll services division, is hesitant to take on any more investment s because he likes to keep his ROI high.

The problem is, however, that if the division does not keep current on its hardware and software, it could start losing business to competitors who stay more abreast of the situation.

Dave Brown, head of Tax Services, knows that he has to keep current if he is going to stay in the business at all. Tax laws change constantly, so keeping up to date with all of the latest changes and incorporating them in the packages it offers to customers is essential if the division is going to continue to survive in its highly competitive marketplace.

Jim Manson knows both divisions are being run well, but they just face very different markets. He would like to keep the company on the edge of technology because he knows that’s what ultimately spells success or disaster in the pay roll industry. He does not like to interfere with his managers, however, instead preferring to allow them to make the decisions they feel are best for their division.

REQUIRED:

a. Compute the discounted value of the cash flows for the four projects presented in the table. Use the company’s WACC as your discount rate. Do the projects yield a positive discounted cash flow?

b. Recompute the discounted cash flow values of the various projects using the division’s separate average ROI. Do the projects yield a positive discounted cash flow now?

c. The net operating profit after tax for the payroll services division before the investment in new assets is projected to be $2.5 million. The comparative number for Tax Services is $850,000. Using RI focusing only on Year 0 cash investments, what would these two divisions do? Specifically, would they invest in the new assets using the corporation’s required 8% WACC? Without the new investment, net operating profit before tax for Payroll Services would be $2 million. Without the investment, net operating profit for Tax Services would be $750,000. Invested capital before the new investments was $8.5 million for the payroll division and $2.5 million for the tax division. To do these calculations, combine the two projects’ costs for each division into one project to simplify the cash flow calculations.

d. What would you recommend that Jim do to motivate Payroll Services to keep abreast of current technology? Why?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant