One of the joys of Amazon's business model is that customers pay straight away while suppliers are

Question:

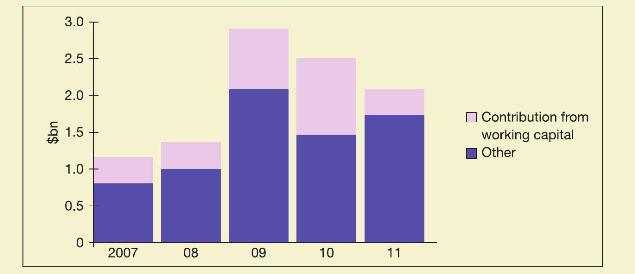

One of the joys of Amazon's business model is that customers pay straight away while suppliers are paid later. When a company is growing quickly, this mismatch (that is, the difference between days receivable and days payable) feeds through to cash flows - though this working capital benefit declines with maturity.

Amazon's free cash flow

Because Amazon pays its suppliers much more slowly than it is paid by its customers, in 2011 it averaged 90 days' worth of sales in payables (money due to be paid out) versus 16 days in receivables (money due to come in). Good inventory management also frees up cash. Over the past five years, these benefits (known as negative working capital) have accounted for almost a third of Amazon's free cash flow . . . this working capital benefit will decline when Amazon's growth slows. Working capital will not be a significant source of cash flow forever.

Discussion points

1 What items, other than working capital, may affect free cash flow (it is not defined in the article)?

2 Why will the working capital benefit for cash decline when growth slows?

Step by Step Answer:

Financial And Management Accounting An Introduction

ISBN: 9780273789215

6th Edition

Authors: Prof Pauline Weetman