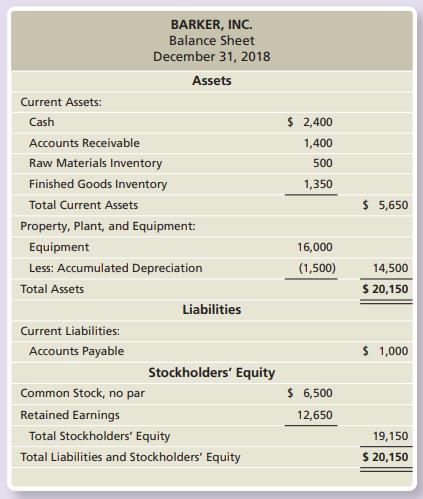

Barker, Inc. has the following balance sheet at December 31, 2018: Barker projects the following transactions for

Question:

Barker, Inc. has the following balance sheet at December 31, 2018:

Barker projects the following transactions for 2019:

Sales on account, ...................................................................$20,000

Cash receipts from customers from sales on account,.... $17,600

Purchase of raw materials on account, ...............................$7,000

Payments on account, ............................................................$3,500

Total cost of completed products, $16,600, which includes the following:

Raw materials used,................................................................ $7,100

Direct labor costs incurred and paid,................................... $3,900

Manufacturing overhead costs incurred and paid,............ $4,800

Depreciation on manufacturing equipment, .........................$800

Cost of goods sold, ................................................................$14,800

Selling and administrative costs incurred and paid, .............$500

Purchase of equipment, paid in 2019,.................................. $2,000

Prepare a budgeted balance sheet for Barker, Inc. for December 31, 2019.

Step by Step Answer:

Horngrens Financial And Managerial Accounting

ISBN: 9780134486833

6th Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura