Canadian Tire Corporation, Limited operates retail stores in Canada that sell general merchandise, clothing, and sporting goods.

Question:

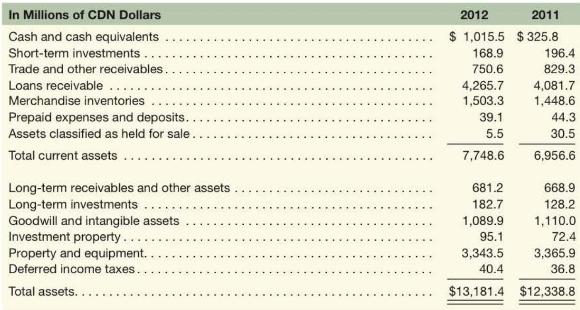

Canadian Tire Corporation, Limited operates retail stores in Canada that sell general merchandise, clothing, and sporting goods. The company offers everyday products and services to Canadians through more than 1,700 retail and gasoline outlets from coast-to-coast. Canadian Tire uses IFRS, and the asset side of the 2012 balance sheet is as follows:

Required

a. Compute inventory turnover and average inventory days outstanding for 2012 (2012 cost of goods sold is \(\$ 7,929.3\) million). Comment on the level of these two ratios. Is the level what we expect given Canadian Tire's industry? Explain.

b. GAAP allows for FIFO, LIFO, and average cost inventory costing methods. How does IFRS differ?

c. In periods of rising prices, how will net income be affected under the different inventory costing methods?

d. Compute the accounts receivable turnover for 2012. The 2012 sales were \(\mathrm{C} \$ 11,427.2\) million and 2011 sales were \(\mathrm{C} \$ 10,387.1\) million. Compute the days' sales outstanding for both years. Compare the two and determine which year has better accounts receivable efficiency. (Hint: Use trade and other receivables in the ratios.)

e. During 2012, the company recorded depreciation expense of C\$335.1 million. Footnotes reported accumulated depreciation on PPE of C\$2,118.6 million, and cost of land and construction in progress of \(\mathrm{C} \$ 744.3\) million and \(\mathrm{C} \$ 102.3\) million respectively. Compute PPE turnover, average useful life, and percent used up for 2012.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton