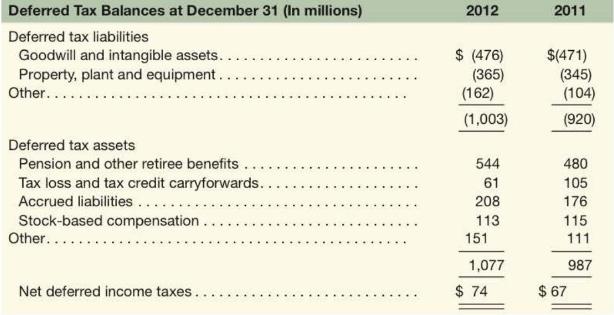

Colgate-Palmolive reports the following income tax footnote disclosure in its (10-mathrm{K}) report. a. Colgate reports ($ 365)

Question:

Colgate-Palmolive reports the following income tax footnote disclosure in its \(10-\mathrm{K}\) report.

a. Colgate reports \(\$ 365\) million of deferred tax liabilities in 2012 relating to "Property." Explain how such liabilities arise.

b. Describe how a deferred tax asset can arise from pension and other retiree benefits.

c. Colgate reports \(\$ 61\) million in deferred tax assets for 2012 relating to tax loss and credit carryforwards. Describe how tax loss carryforwards arise and under what conditions the resulting deferred tax assets will be realized.

d. Colgate's income statement reports income tax expense of \(\$ 1,243\) million. Assume that cash paid for income tax is \(\$ 1,280\) million and that taxes payable decreased by \(\$ 30\) million. Use the financial statement effects template to record tax expense for 2012.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton