Dakota Mining Company has two competing proposals: a diamond core drill or a hydraulic excavator. Both pieces

Question:

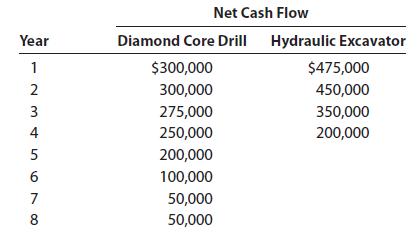

Dakota Mining Company has two competing proposals: a diamond core drill or a hydraulic excavator. Both pieces of equipment have an initial investment of $900,000. The net cash flows estimated for the two proposals are as follows:

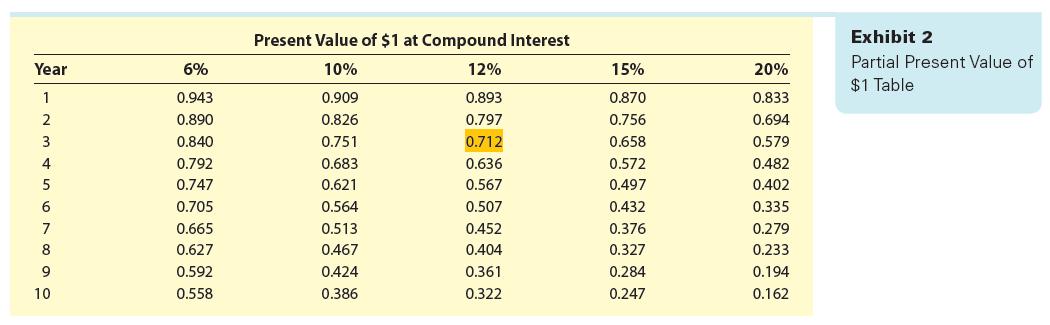

The estimated residual value of the diamond core drill at the end of Year 4 is $450,000. Determine which equipment should be favored, comparing the net present values of the two proposals and assuming a minimum rate of return of 15%. Use the present value table appearing in Exhibit 2 of this chapter.

Exhibit 2

Transcribed Image Text:

Year 12 3 45678 Net Cash Flow Diamond Core Drill Hydraulic Excavator $300,000 300,000 275,000 250,000 200,000 100,000 50,000 50,000 $475,000 450,000 350,000 200,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

The net present value of both proposals is positive thus both pieces of equipment are ...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Financial And Managerial Accounting

ISBN: 9780357714041

16th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William Tayler

Question Posted:

Students also viewed these Business questions

-

Gold Creek Mining Company has two competing proposals: a processing mill and an electric shovel. Both pieces of equipment have an initial investment of $846,778. The net cash flows estimated for the...

-

The net cash flows from an investment project are $-15,000 in the first year, $ -11,000 in the second year, $5,000 in the third year, $1,800 in the fourth year, $7,000 in the fifth year, $6,400 in...

-

The net cash flows from an investment are -X dollars in the first year, positive Y dollars in year T, and zero in all other years. Write a formula for the NPV. Set the NPV equal to zero, and solve...

-

Bank Teller Staffing Plan As the teller supervisor at Montana Federal Credit Union you are responsible for developing a staffing plan for tellers that meets customer needs, satisfies the union...

-

Ford was accused of age discrimination based on the use of its forced-distribution rating system. What evidence would you investigate to test this allegation?

-

How many lone pairs of electrons are on the P atom of PCl 3 ?

-

E12.9. Analysis of Changes in Operating Profitability: Home Depot, Inc. (Medium) Comparative income statements and balance sheets for the warehouse retailer Home Depot are given in Exercise E11.10 in...

-

Summarized versions of Calabasa Corporations financial statements for two recent years are as follows. Requirement 1. Complete Calabasa Corporations financial statements by determining the missing...

-

Lime company purchased 3 0 0 units for $ 3 0 each on January 3 1 . It purchased 1 2 0 units for $ 4 0 each on February 2 8 . It sold 1 7 5 units for $ 5 5 each from March 1 through December 3 1 . If...

-

Payments of $1750 and $1600 are due four months from now and nine months from now respectively. What single payment is required to pay off the two scheduled payments today if interest is 9% and the...

-

The internal rate of return method is used by Royston Construction Co. in analyzing a capital expenditure proposal that involves an investment of $108,875 and annual net cash flows of $25,000 for...

-

Doughnut production at Krispy Kreme (DNUT) is an exact process based upon measurement and testing. The standardized process provides the exact time necessary, no more, no less, for doughnuts to rise,...

-

The most popular model of mobile phone among 4,00,000 mobile phone purchasers Determine whether you would take a census or use a sampling. If you would use a sampling, determine which sampling...

-

Determine the magnitude of the magnetic flux through the south-facing window of a house in British Columbia, where Earth's B field has a magnitude of 5.8 x 10-5T and the direction of B field is 72...

-

A wedge with an inclination of angle rests next to a wall. A block of mass m is sliding down the plane, as shown. There is no friction between the wedge and the block or between the wedge and the...

-

Conner Leonard worked for Purges Manufacturing for 32 years. Along with four other men, he helped to start the company that designed and built products sold around the world. Purges Manufacturing...

-

Reconsider the collision between two objects diagrammed below where two objects move on a frictionless surface. Before collision After collision Experiment 1 A, 1 B A B Draw complete and properly...

-

3. Now the bomb arrives. Please catch fx,y(x, y) = = cx cx - dy, where 0 < x < 1, 0 y x. 13 a) Please find coefficients c, d such that cd= 8 b) Please find fx(x) and fy (y). Are X and Y independent?...

-

Consider the preference table below. Assume that a majority is needed to win the election. Since no candidate has a majority but C has the most first-place votes, a runoff election is held between A...

-

What kind of financial pressures can an LBO cause?

-

Based on the data presented in Exercise 5-23, Journalize Boyle Co.s entries for (a) The purchase, (b) The return of the merchandise for credit, and (c) The payment of the invoice within the discount...

-

What is the normal balance of the following accounts? (a) Cost of Merchandise Sold, (b) Delivery Expense, (c) Merchandise Inventory, (d) Sales (e) Sales Discounts (f) Sales Returns and Allowances,...

-

Old Faithful Tile Co.s perpetual inventory records indicate that $715,950 of merchandise should be on hand on December 31, 2012. The physical inventory indicates that $693,675 of merchandise is...

-

Dr. Claudia Gomez, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal...

-

QUESTION 2 ( 2 0 Marks ) 2 . 1 REQUIRED Study the information provided below and prepare the Income Statement for the year ended 3 1 December 2 0 2 3 using the marginal costing method. INFORMATION...

-

DROP DOWN OPTIONS: FIRST SECOND THIRD FOURTH 5. Cost of new common stock A firm needs to take flotation costs into account when it is raising capital fromY True or False: The following statement...

Study smarter with the SolutionInn App