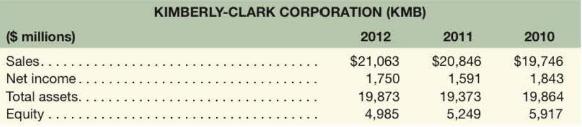

Following are summary financial statement data for Kimberly-Clark for 2010 through 2012. Required a. Compute the return

Question:

Following are summary financial statement data for Kimberly-Clark for 2010 through 2012.

Required

a. Compute the return on assets and return on equity for 2011 and 2012 (use average assets and average equity), together with the components of ROA (profit margin and asset turnover). What trends do we observe?

b. Which component appears to be driving the change in ROA over this time period?

c. KMB repurchased a large amount of its common shares in recent years at a cost of almost ($ 4.9) billion. How did this repurchase affect its return on equity?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted: