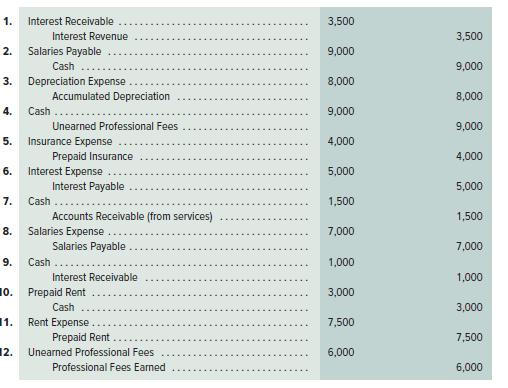

For each of the following journal entries 1 through 12, enter the letter of the explanation that

Question:

For each of the following journal entries 1 through 12, enter the letter of the explanation that most closely describes it in the space beside each entry. (You can use letters more than once.)

A. To record payment of a prepaid expense.

B. To record this period’s use of a prepaid expense.

C. To record this period’s depreciation expense.

D. To record receipt of unearned revenue.

E. To record this period’s earning of prior unearned revenue.

F. To record an accrued expense.

G. To record payment of an accrued expense.

H. To record an accrued revenue.

I. To record receipt of accrued revenue.

Natsu Company’s annual accounting period ends on October 31, 2017. The following information concerns the adjusting entries that need to be recorded as of that date. (Entries can draw from the following partial chart of accounts: Cash; Rent Receivable; Office Supplies; Prepaid Insurance; Building;

Accumulated Depreciation—Building; Salaries Payable; Unearned Rent; Rent Earned; Salaries Expense;

Office Supplies Expense; Insurance Expense; Depreciation Expense—Building.)

a. The Office Supplies account started the fiscal year with a $600 balance. During the fiscal year, the company purchased supplies for $4,570, which was added to the Office Supplies account. The supplies available at October 31, 2017, totaled $800.

b. An analysis of the company’s insurance policies provided the following facts.

The total premium for each policy was paid in full (for all months) at the purchase date, and the Prepaid Insurance account was debited for the full cost. (Year-end adjusting entries for Prepaid Insurance were properly recorded in all prior fiscal years.)

c. The company has four employees, who earn a total of $1,000 for each workday. They are paid each Monday for their work in the five-day workweek ending on the previous Friday. Assume that October 31, 2017, is a Monday, and all four employees worked the first day of that week. They will be paid salaries for five full days on Monday, November 7, 2017.

d. The company purchased a building on November 1, 2014, that cost $175,000 and is expected to have a $40,000 salvage value at the end of its predicted 25-year life. Annual depreciation is $5,400.

e. Since the company does not occupy the entire building it owns, it rented space to a tenant at $1,000 per month, starting on September 1, 2017. The rent was paid on time on September 1, and the amount received was credited to the Rent Earned account. However, the October rent has not been paid. The company has worked out an agreement with the tenant, who has promised to pay both October and November rent in full on November 15. The tenant has agreed not to fall behind again.

f. On September 1, the company rented space to another tenant for $725 per month. The tenant paid five months’ rent in advance on that date. The payment was recorded with a credit to the Unearned Rent account.

Required 1. Use the information to prepare adjusting entries as of October 31, 2017.

2. Prepare journal entries to record the first subsequent cash transaction in November 2017 for parts c and e.

Step by Step Answer:

Financial And Managerial Accounting Information For Decisions

ISBN: 9781259726705

7th Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta