Forecasting the Income Statement, Balance Sheet, and Statement of Cash Flows (LO2, 3, 4) Following are the

Question:

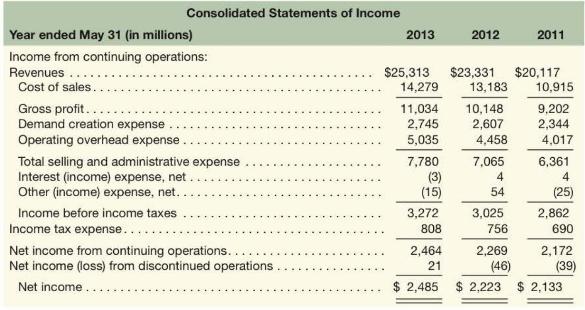

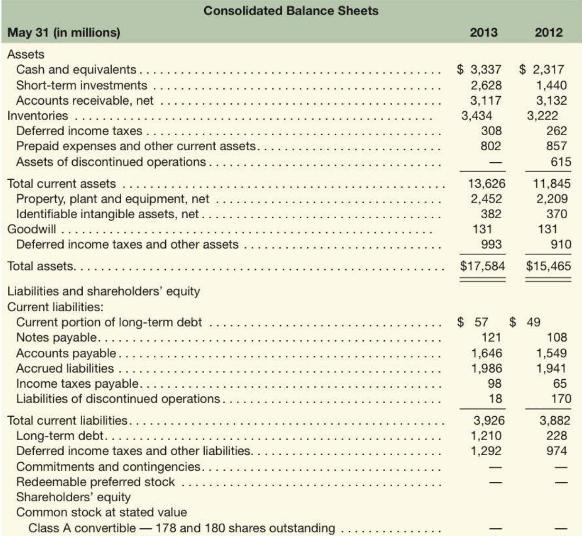

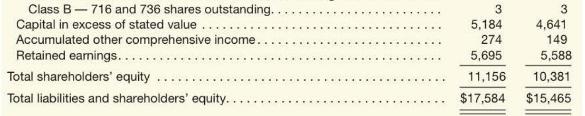

Forecasting the Income Statement, Balance Sheet, and Statement of Cash Flows (LO2, 3, 4) Following are the financial statements of Nike, Inc.

Required

Forecast Nike's fiscal year 2014 income statement, balance sheet, and statement of cash flows. Round the revenue growth rate to the nearest whole percent and round forecasts to \(\$\) millions. Identify all financial statement relations estimated and assumptions made; estimate forecasted income statement relations to 3 decimal places, for example, Inventories/Revenues is \(13.6 \%\) (assume no change for: other expense or income, liabilities of discontinued operations, goodwill, notes payable, common stock, capital in excess of stated value, and accumulated other comprehensive income). Also assume no income/loss from discontinued operations for fiscal 2014. For fiscal 2013, capital expenditures are \(\$ 636\) million, depreciation expense is \(\$ 438\) million, amortization is \(\$ 75\) million, and dividends are \(\$ 703\) million. Footnotes reveal that the current portion of long-term debt due in 2015 is \(\$ 46\) million. What do the forecasts imply about Nike's financing needs for the upcoming year?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton