General Mills, Inc. reports the following fiscal year income statements. Forecast General Mills' fiscal year 2014 income

Question:

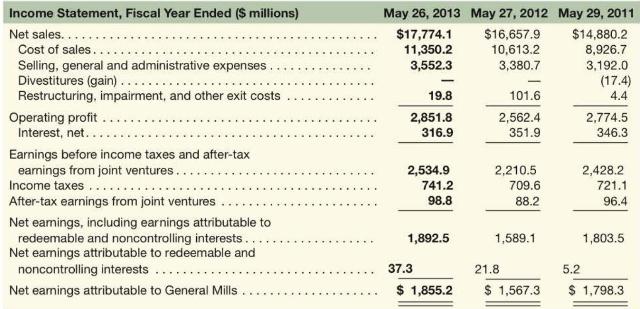

General Mills, Inc. reports the following fiscal year income statements.

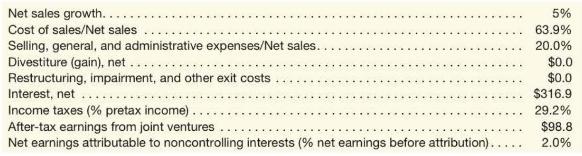

Forecast General Mills' fiscal year 2014 income statement assuming the following income statement relations (\$ in millions). All percentages (other than net sales growth, income taxes, and net earnings attributable to noncontrolling interests) are based on percent of sales.

Transcribed Image Text:

Income Statement, Fiscal Year Ended ($ millions) Net sales... Cost of sales. Selling, general and administrative expenses Divestitures (gain)... Restructuring, impairment, and other exit costs Operating profit Interest, net... Earnings before income taxes and after-tax earnings from joint ventures.. Income taxes.. After-tax earnings from joint ventures Net earnings, including earnings attributable to redeemable and noncontrolling interests.. Net earnings attributable to redeemable and noncontrolling interests Net earnings attributable to General Mills May 26, 2013 $17,774.1 11,350.2 3,552.3 19.8 2,851.8 316.9 2,534.9 741.2 98.8 1,892.5 37.3 $ 1,855.2 May 27, 2012 May 29, 2011 $14,880.2 8,926.7 3,192.0 $16,657.9 10,613.2 3,380.7 101.6 2,562.4 351.9 2,210.5 709.6 88.2 1,589.1 21.8 $ 1,567.3 5.2 (17.4) 4.4 2,774.5 346.3 2,428.2 721.1 96.4 1,803.5 1,798.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Krishnavendra Y

I am a self motivated financial professional knowledgeable in; preparation of financial reports, reconciling and managing accounts, maintaining cash flows, budgets, among other financial reports. I possess strong analytical skills with high attention to detail and accuracy. I am able to act quickly and effectively when dealing with challenging situations. I have the ability to form positive relationships with colleagues and I believe that team work is great key to performance. I always deliver quality, detailed, original (0% plagiarism), well-researched and critically analyzed papers.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted:

Students also viewed these Business questions

-

Refer to the General Mills, Inc. information in M11-13. Assume the forecast of 2014 net sales is \(\$ 18,662.8\) million. Use the following financial statement relations to forecast General Mills'...

-

Explain the relationship between Social Responsibility and Profit in detail. Is there any relationship between these two. Why Yes Why No Case analyses are summaries of your preparation of a case,...

-

Can you please provide a feedback to this post? 1. What is the managerial view on business? What are the stakeholders view on business? How do they differ? The management viewpoint on business...

-

Consider a soap bubble. Is the pressure inside the bubble higher or lower than the pressure outside?

-

Read the scenario Katrina's Candies and suggest one (1) method in which Herb could use a cost-benefit analysis to argue for or against an expansion. Create three (3) optimal decision rules for...

-

Explain why K 2 [PtCl 4 ] is first converted to K 2 [PtI 4 ] in the synthesis of the anticancer drug cisplatin, cis-PtCl 2 (NH 3 ) 2 .

-

How do company managements use information about scrap? EXERCISES

-

Ambrose Corporation owns 75 percent of Kroop Company's common stock, acquired at underlying book value on January 1, 20X4. At the acquisition date, the book values and fair values of Kroop's assets...

-

Yahoo FinanceExamine the annual report for a public-listed firm in Malaysia, particularly the chairmans statement. What does it say about corporate social responsibility and sustainability? 300-400...

-

Harley-Davidson, Inc. reports 2012 net operating working capital of \$1,888 million and 2012 longterm operating assets of \(\$ 4,380\) million. a. Forecast Harley-Davidson's 2013 net operating...

-

Macy's, Inc. reports the following income statements. Forecast Macy's fiscal 2014 income statement assuming the following income statement relations ( \(\$\) in millions). All percentages (other than...

-

The file P14_42.xlsx contains monthly data on consumer revolving credit (in millions of dollars) through credit unions. a. Use these data to forecast consumer revolving credit through credit unions...

-

Gordon Rivers, the city manager of Saratoga, Florida, pitched the proposed design schedule back at Jay Andrews. Jay Andrews is the project manager for Major Design Corporation (MDC). The city of...

-

Use the data from SE3-8 to prepare the closing entries for The Decade Company. Close the temporary accounts straight to retained earnings. The balance of \(\$ 8,500\) in the retained earnings account...

-

Draw a Keynesian cross diagram to show the effects of a rise in autonomous expenditure on an economy operating below full employment output.

-

Governments in many countries are acutely aware of the environmental problems that vehicle emissions can have. Many car manufacturers are exploring the production of electric vehicles, but production...

-

Draw a simple diagram of John Woodens pyramid of success. You can find it at the official Wooden website www.coachwooden.com/index2.html.

-

Laser Corporation, a U.S. corporation, has a foreign office that conducts business in France. Laser pays foreign taxes of $74,000 on foreign-source taxable income of $185,000. Its U.S.-source taxable...

-

A city maintains a solid waste landfill that was 12 percent filled at the end of Year 1 and 26 percent filled at the end of Year 2. During those periods, the government estimated that total closure...

-

Use the following information to determine cash flows from financing activities. a. Net income was $35,000. b. Issued common stock for $64,000 cash. c. Paid cash dividend of $14,600. d. Paid $50,000...

-

For each of the following separate transactions, (a) prepare the reconstructed journal entry and (b) identify the effect it has, if any, on the investing section or financing section of the statement...

-

Pritchett Co. reported the following year-end data: cash of $15,000; short-term investments of $5,000; accounts receivable (current) of $8,000; inventory of $20,000; prepaid (current) assets of...

-

1. (A nice inharitage) Suppose $1 were invested in 1776 at 3.3% interest compounded yearly a) Approximatelly how much would that investment be worth today: $1,000, $10,000, $100,000, or $1,000,000?...

-

Why Should not the government subsidize home buyers who make less than $120K per year. please explain this statement

-

Entries for equity investments: 20%50% ownership On January 6, 20Y8, Bulldog Co. purchased 25% of the outstanding common stock of $159,000. Gator Co. paid total dividends of $20,700 to all...

Study smarter with the SolutionInn App