Question:

Hewlett-Packard, Inc., reports the following footnote disclosure (excerpted) in its 2012 10-K relating to its 2012 restructuring program.

Required

a. Briefly describe the company's 2012 restructuring program. Provide two examples of common noncash charges associated with corporate restructuring activities.

b. Using the financial statement effects template, show the effects on financial statements of the (1) 2012 restructuring charge of \(\$ 2,266\) million, and (2) 2012 cash payment of \(\$ 840\) million.

c. Assume that instead of accurately estimating the anticipated restructuring charge in 2012, the company overestimated them by \(\$ 30\) million. How would this overestimation affect financial statements in (1) 2012, and (2) 2013 when severance costs are paid in cash?

d. The company reports that the total charges will amount to \(\$ 3.7\) billion. What is the effect on the 2012 income statement from this restructuring? Why do investors care to know the total charge if it does not impact current-period earnings?

Transcribed Image Text:

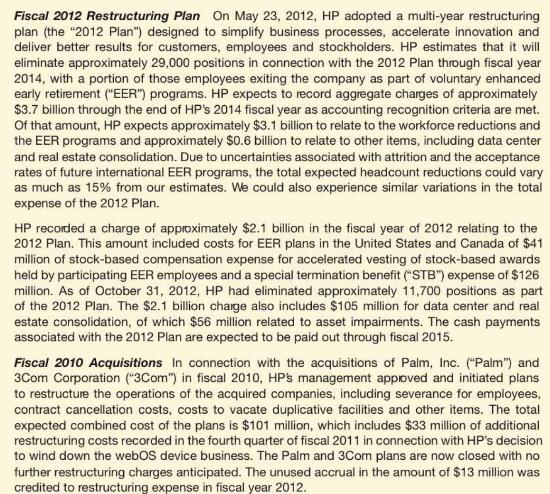

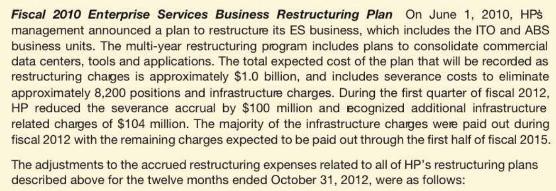

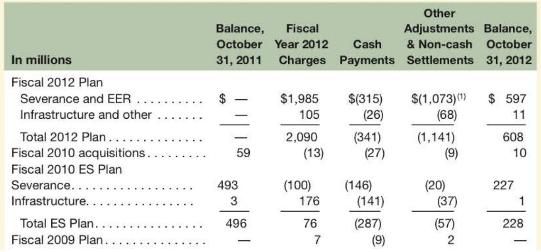

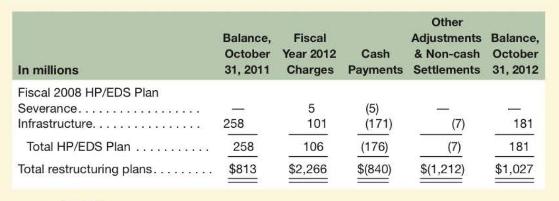

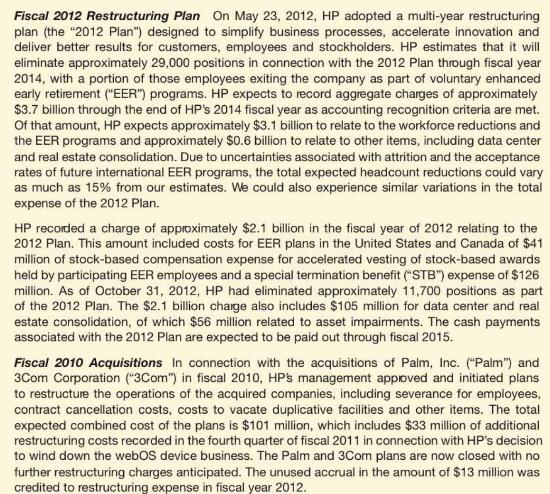

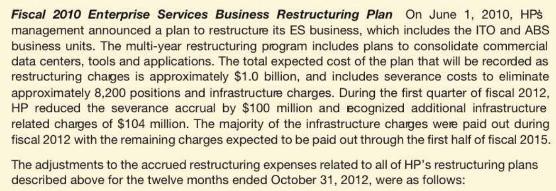

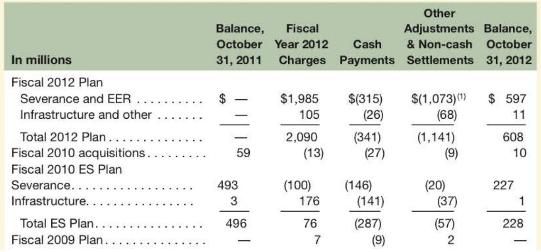

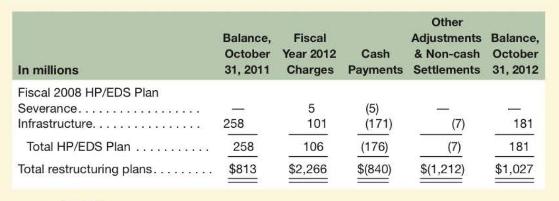

Fiscal 2012 Restructuring Plan On May 23, 2012, HP adopted a multi-year restructuring plan (the "2012 Plan") designed to simplify business processes, accelerate innovation and deliver better results for customers, employees and stockholders. HP estimates that it will eliminate approximately 29,000 positions in connection with the 2012 Plan through fiscal year 2014, with a portion of those employees exiting the company as part of voluntary enhanced early retirement ("EER") programs. HP expects to record aggregate charges of approximately $3.7 billion through the end of HP's 2014 fiscal year as accounting recognition criteria are met. Of that amount, HP expects approximately $3.1 billion to relate to the workforce reductions and the EER programs and approximately $0.6 billion to relate to other items, including data center and real estate consolidation. Due to uncertainties associated with attrition and the acceptance rates of future international EER programs, the total expected headcount reductions could vary as much as 15% from our estimates. We could also experience similar variations in the total expense of the 2012 Plan. HP recorded a charge of approximately $2.1 billion in the fiscal year of 2012 relating to the 2012 Plan. This amount included costs for EER plans in the United States and Canada of $41 million of stock-based compensation expense for accelerated vesting of stock-based awards held by participating EER employees and a special termination benefit ("STB") expense of $126 million. As of October 31, 2012, HP had eliminated approximately 11,700 positions as part of the 2012 Plan. The $2.1 billion charge also includes $105 million for data center and real estate consolidation, of which $56 million related to asset impairments. The cash payments associated with the 2012 Plan are expected to be paid out through fiscal 2015. Fiscal 2010 Acquisitions In connection with the acquisitions of Palm, Inc. ("Palm") and 3Com Corporation ("3Com") in fiscal 2010, HP's management approved and initiated plans to restructure the operations of the acquired companies, including severance for employees, contract cancellation costs, costs to vacate duplicative facilities and other items. The total expected combined cost of the plans is $101 million, which includes $33 million of additional restructuring costs recorded in the fourth quarter of fiscal 2011 in connection with HP's decision to wind down the webOS device business. The Palm and 3Com plans are now closed with no further restructuring charges anticipated. The unused accrual in the amount of $13 million was credited to restructuring expense in fiscal year 2012.