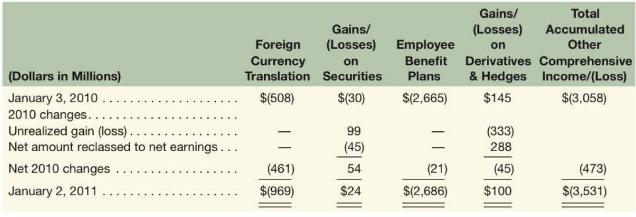

Johnson & Johnson reports the following schedule of other comprehensive income in its 2011 10-K report ($

Question:

Johnson \& Johnson reports the following schedule of other comprehensive income in its 2011 10-K report (\$ millions):

a. Describe how firms like Johnson \& Johnson typically use derivatives.

b. How does Johnson \& Johnson report its derivatives designated as cash-flow hedges on its balance sheet?

c. By what amount have the unrealized losses of \(\$(333)\) million on the cash-flow hedges affected current income? What are the analysis implications?

d. What does the \(\$ 288\) million classified as "Net amount reclassed to net earnings" relate to? How has this affected Johnson \& Johnson's profit?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted: