Kadous Consulting, a firm started three years ago by K. Kadous, offers consulting services for material handling

Question:

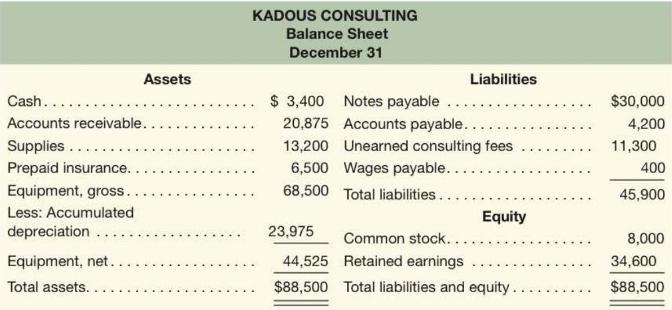

Kadous Consulting, a firm started three years ago by K. Kadous, offers consulting services for material handling and plant layout. Its balance sheet at the close of the current year follows.

Earlier in the year Kadous obtained a bank loan of \(\$ 30,000\) cash for the firm. A provision of the loan is that the year-end debt-to-equity ratio (total liabilities to total equity) cannot exceed 1.0. Based on the above balance sheet, the ratio at December 31 of this year is 1.08 . Kadous is concerned about being in violation of the loan agreement and requests assistance in reviewing the situation. Kadous believes that she might have overlooked some items at year-end. Discussions with Kadous reveal the following.

1. On January 1 of this year, the firm paid a \(\$ 6,500\) insurance premium for two years of coverage; the amount in Prepaid Insurance has not yet been adjusted.

2. Depreciation on equipment should be \(10 \%\) of cost per year; the company inadvertently recorded \(15 \%\) for this year.

3. Interest on the bank loan has been paid through the end of this year.

4. The firm concluded a major consulting engagement in December, doing a plant layout analysis for a new factory. The \(\$ 8,000\) fee has not been billed or recorded in the accounts.

5. On December 1 of this year, the firm received an \(\$ 11,300\) cash advance payment from Dichev Corp. for consulting services to be rendered over a two-month period. This payment was credited to the Unearned Consulting Fees account. One-half of this fee was earned but unrecorded by December 31 of this year.

6. Supplies costing \(\$ 4,800\) were available on December 31 ; the company has made no adjustment of its Supplies account.

\section*{Required}

a. What is the correct debt-to-equity ratio at December 31 ?

\(b\). Is the firm in violation of its loan agreement? Prepare computations to support the correct total liabilities and total equity figures at December 31.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton