Potash Corporation of Saskatchewan - the world's largest potash producer - is a Canadian corporation based in

Question:

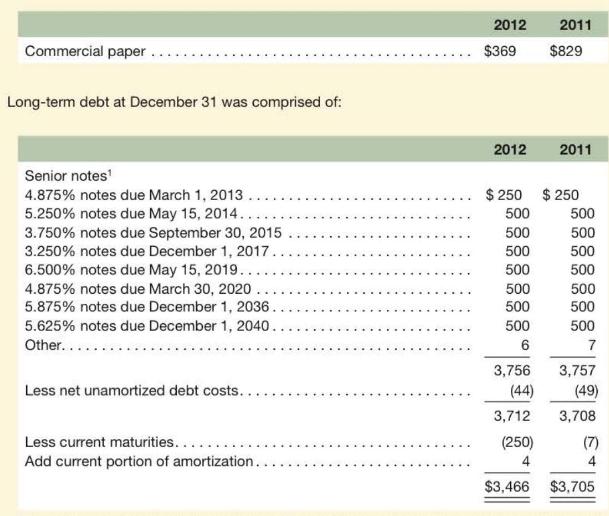

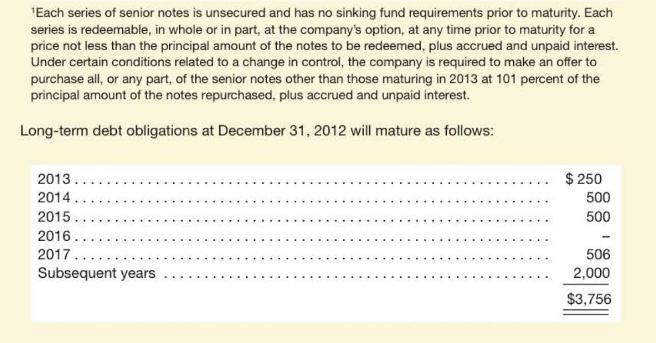

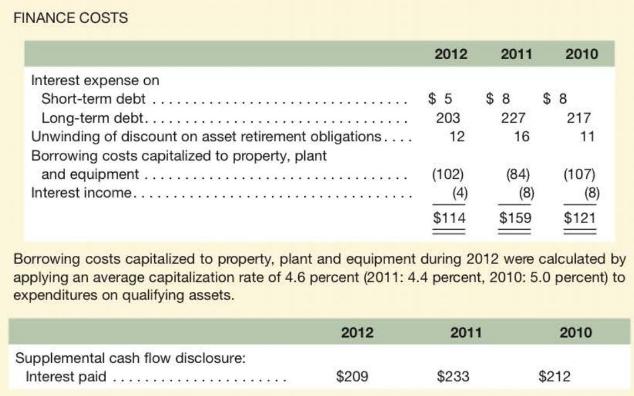

Potash Corporation of Saskatchewan - the world's largest potash producer - is a Canadian corporation based in Saskatoon, Saskatchewan. The company produces nitrogen and phosphate used to produce fertilizer. At the end of 2011 , the company controlled \(20 \%\) of the world's potash production capacity, \(2 \%\) of nitrogen production capacity and \(5 \%\) of phosphate supply. Its 2012 financial statements disclose the following as part of its long-term debt footnote.

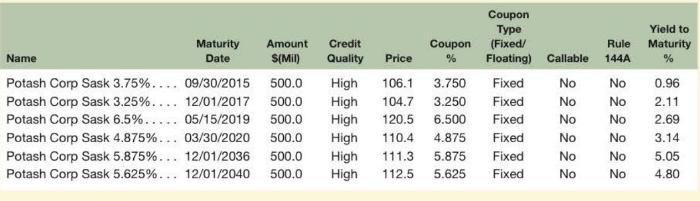

Reproduced below is a summary of the May 2013 market values of the Potash bonds maturing from 2015 to 2040 (from Morningstar, quicktake.morningstar.com).

a. What is the average coupon rate (interest paid) and the average effective rate (interest expense) on long-term debt?

b. Does the coupon rate computed in part \(a\) seem reasonable given the footnote disclosure relating to specific bond issues? Explain.

c. Explain how the amount of interest paid in cash can differ from the amount of interest expense recorded in the income statement.

d. On its 2012 balance sheet, Potash reports current maturities of long-term debt of \(\$ 246\) million as part of short-term debt. Why is this amount reported that way? Is this amount important to our analysis of Potash? Explain.

e. The table above shows that the \(\$ 500\) million \(5.625 \%\) note due in 2040 is priced at \(112.5(112.50 \%\) of face value, or \(\$ 562.5\) million) as of 2012 , resulting in a yield to maturity of \(4.80 \%\). Assuming that the credit rating of Potash has not changed, what does the pricing of this \(5.625 \%\) coupon bond imply about interest rate changes since Potash issued the bond?

f. Examine the yield to maturity of the bonds in the table above. What relation do we observe between these yields and the maturities of the bonds? Also, explain why this relation applies in general.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton