Refer to Samsungs financial statements in Appendix A. Compute its debt ratio as of December 31, 2015,

Question:

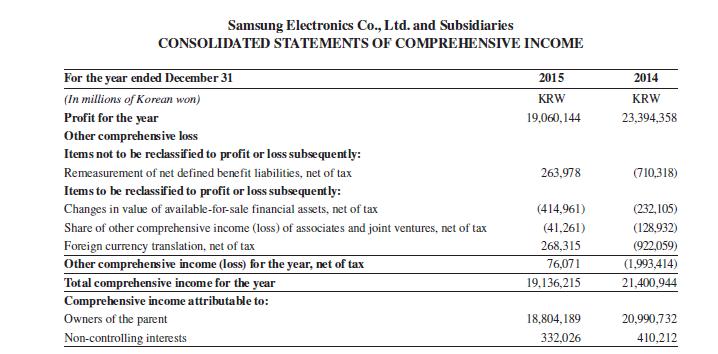

Refer to Samsung’s financial statements in Appendix A. Compute its debt ratio as of December 31, 2015, and December 31, 2014.

Data From Samsung Financial Statement Appendix A

Transcribed Image Text:

Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31 (In millions of Korean won) Profit for the year 2015 2014 KRW KRW 19,060,144 23,394,358 Other comprehensive loss Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax 263,978 (710,318) Items to be reclassified to profit or loss subsequently: Changes in value of available-for-sale financial assets, net of tax (414,961) (232,105) Share of other comprehensive income (loss) of associates and joint ventures, net of tax (41,261) (128,932) Foreign currency translation, net of tax 268,315 (922,059) Other comprehensive income (loss) for the year, net of tax 76,071 (1,993,414) Total comprehensive income for the year 19,136,215 21,400,944 Comprehensive income attributable to: Owners of the parent Non-controlling interests 18,804,189 20,990,732 332,026 410,212

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Sarfraz gull

have strong entrepreneurial and analytical skills which ensure quality tutoring and mentoring in your international business and management disciplines. Over last 3 years, I have expertise in the areas of Financial Planning, Business Management, Accounting, Finance, Corporate Finance, International Business, Human Resource Management, Entrepreneurship, Marketing, E-commerce, Social Media Marketing, and Supply Chain Management.

Over the years, I have been working as a business tutor and mentor for more than 3 years. Apart from tutoring online I have rich experience of working in multinational. I have worked on business management to project management.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Financial And Managerial Accounting Information For Decisions

ISBN: 9781259726705

7th Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta

Question Posted:

Students also viewed these Business questions

-

Refer to Samsungs financial statements in Appendix A. Compute its debt ratio as of December 31, 2017,and December 31, 2016. Data from Samsung Samsung Electronics Co., Ltd. and Subsidiaries...

-

Refer to Googles financial statements in Appendix A to compute its equity ratio as of December 31, 2015, and December 31, 2014. Data From Google Financial Statement Appendix A Google Inc....

-

Refer to Nokias financial statements in Appendix A. Compute its debt ratio as of December 31, 2009, and December 31, 2008.

-

Stock X has 32% standard deviation of return. Stock Y has 32% standard deviation of return. The correlation between the returns of the two stocks is 64%. Buck's portfolio consists of equal...

-

From the following, prepare a chart of accounts. Apple iPad ................................................ Legal Fees Earned Salary Expense ........................................... L. Jonas,...

-

Explain the salient characteristics of term, whole, universal, and variable life insurance policies. Appendix

-

Museum management. Refer to the Museum Management and Curatorship (June 2010) study of the criteria used to evaluate museum performance, Exercise 2.14 (p. 68). Recall that the managers of 30 leading...

-

Andular Financial Services was organized on April 1 of the current year. On April 2, Andular prepaid $9,000 to the city for taxes (license fees) for the next 12 months and debited the prepaid taxes...

-

QUESTION 1 CASE STUDY ANNUAL WORTH ANALYSIS-THEN AND NOW Background and Information Mohamad, owner of an residential furnished apartment's in Dubai, performed an economic analysis 3 years ago when he...

-

Refer to the information in QS 13-4. Use that information for Tide Corporation to determine the 2016 and 2017 common-size percents for cost of goods sold using net sales as the base. Data From QS...

-

On October 1, 2017, Gordon borrows \($150\),000 cash from a bank by signing a three-year installment note bearing 10% interest. The note requires equal payments of \($60\),316 each year on September...

-

Assume that a firm changes its cost basis for inventory from acquisition cost to current cost, that current costs exceed acquisition costs at the end of the year of change, and that the firm sells...

-

The balances of selected accounts of Casper Company on February 28, 20X1, were as follows: Sales $250,000 and Sales Returns and Allowances $4,000. The firm's net sales are subject to an 7 percent...

-

1. Draw and label force diagrams for the physics book and for the calculator. Add equality marks showing any equalities between force diagrams. Circle and label any Newton's third law pairs. (6 pts)...

-

Consider the Lincoln Tunnel, which was built in 1939 under the Hudson River in New York. Assume the tunnel to be empty with perfectly conducting walls and rectangular cross section with width 6.55 m...

-

Examine a well-known principal-agent contract, the sale of your home by a licensed realtor. You will use the following data to analyze this case. Your home is the typical home, approximately 1,875 sq...

-

i) Generate a third degree polynomial in x and y named g(x, y) that is based on your mobile number (Note: In case there is a 0 in one of the digits replace it by 3). Suppose your mobile number is...

-

What factors influence a speculative premium on an option?

-

The Pletcher Transportation Company uses a responsibility reporting system to measure the performance of its three investment centers: Planes, Taxis, and Limos. Segment performance is measured using...

-

Be prepared to explain the texts comprehensive To illustrate the issues related to interest capitalization, assume that on November 1, 2016, Shalla Company contracted Pfeifer Construction Co. to...

-

On April 1, 2020. Indigo Company received a condemnation award of $473,000 cash as compensation for the forced sale of the company's land and building, which stood in the path of a new state highway....

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

Study smarter with the SolutionInn App