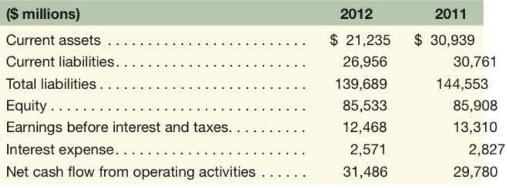

Selected balance sheet and income statement information from Verizon Communications, Inc. follows. a. Compute the current ratio

Question:

Selected balance sheet and income statement information from Verizon Communications, Inc. follows.

a. Compute the current ratio for each year and discuss any trend in liquidity. What additional information about the numbers used to calculate this ratio might be useful in helping us assess liquidity? Explain.

b. Compute times interest earned and the liabilities-to-equity for each year and discuss any noticeable change. (The average liabilities-to-equity ratio for the telecommunications industry is 1.7.) Do you have any concerns about Verizon's financial leverage and the company's ability to meet interest obligations? Explain.

c. Verizon's capital expenditures are expected to increase substantially as it seeks to respond to competitive pressures to upgrade the quality of its communication infrastructure. Assess Verizon's liquidity and solvency in light of this strategic direction.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton