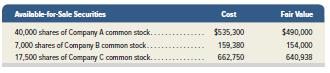

Stoll Co.s long-term available-for-sale portfolio at December 31, 2016, consists of the following. Stoll enters into the

Question:

Stoll Co.’s long-term available-for-sale portfolio at December 31, 2016, consists of the following.

Stoll enters into the following long-term investment transactions during year 2017.

Jan. 29 Sold 3,500 shares of Company B common stock for $79,188 less a brokerage fee of $1,500.

Apr. 17 Purchased 10,000 shares of Company W common stock for $197,500 plus a brokerage fee of $2,400. The shares represent a 30% ownership in Company W.

July 6 Purchased 4,500 shares of Company X common stock for $126,562 plus a brokerage fee of $1,750. The shares represent a 10% ownership in Company X.

Aug. 22 Purchased 50,000 shares of Company Y common stock for $375,000 plus a brokerage fee of $1,200. The shares represent a 51% ownership in Company Y.

Nov. 13 Purchased 8,500 shares of Company Z common stock for $267,900 plus a brokerage fee of $2,450. The shares represent a 5% ownership in Company Z.

Dec. 9 Sold 40,000 shares of Company A common stock for $515,000 less a brokerage fee of $4,100.

The fair values of its investments at December 31, 2017, are: B, $81,375; C, $610,312; W, $191,250; X, $118,125; Y, $531,250; and Z, $278,800.

Required 1. Determine the amount Stoll should report on its December 31, 2017, balance sheet for its long-term investments in available-for-sale securities.

2. Prepare any necessary December 31, 2017, adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities.

3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale securities should Stoll report on its December 31, 2017, income statement?

Step by Step Answer:

Financial And Managerial Accounting Information For Decisions

ISBN: 9781259726705

7th Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta