The St. Louis to Seattle Railroad is considering acquiring equipment at a cost of $3,600,000. The equipment

Question:

The St. Louis to Seattle Railroad is considering acquiring equipment at a cost of $3,600,000. The equipment has an estimated life of 8 years and no residual value. It is expected to provide yearly net cash flows of $750,000. The company’s minimum desired rate of return for net present value analysis is 12%.

Compute the following:

a. The average rate of return, giving effect to straight-line depreciation on the investment.

b. The cash payback period.

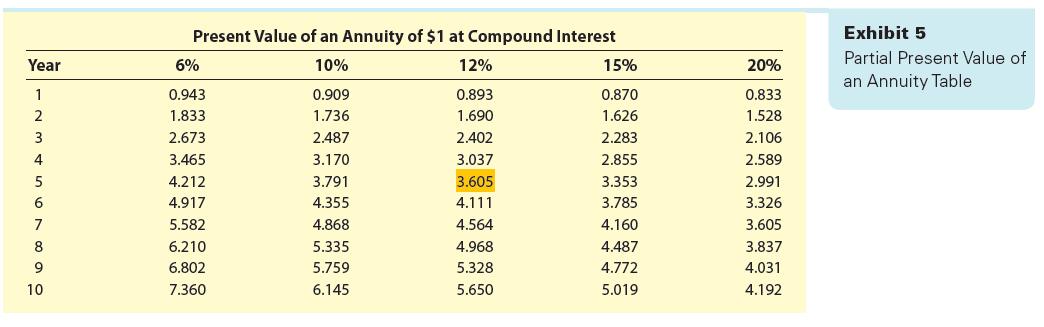

c. The net present value. Use the present value of an annuity table appearing in Exhibit 5 of this chapter.

Exhibit 5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting

ISBN: 9780357714041

16th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William Tayler

Question Posted: