Yoshi Company completed the following transactions and events involving its delivery trucks. Required Prepare journal entries to

Question:

Yoshi Company completed the following transactions and events involving its delivery trucks.

Required

Prepare journal entries to record these transactions and events.

Transcribed Image Text:

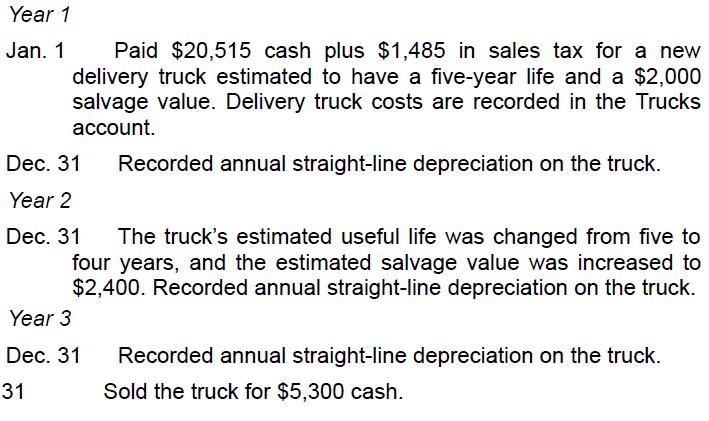

Year 1 Jan. 1 Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estimated to have a five-year life and a $2,000 salvage value. Delivery truck costs are recorded in the Trucks account. Dec. 31 Year 2 Dec. 31 Recorded annual straight-line depreciation on the truck. The truck's estimated useful life was changed from five to four years, and the estimated salvage value was increased to $2,400. Recorded annual straight-line depreciation on the truck. Year 3 Dec. 31 31 Recorded annual straight-line depreciation on the truck. Sold the truck for $5,300 cash.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

Year 1 January 1 Debit Trucks 21990 20515 1485 Credit Cash 21990 December 31 Debit Depreciation Expe...View the full answer

Answered By

NITIN CHAUDHARY

I have done Masters in SCIENCE (PHYSICS) from MEERUT UNIVERSITY, CAMPUS. Also one project in IIT INDORE on nano materials to detect heavey metals in water. I have thought physics to B.TECH students for 1 year. Presently I am a teacher of physics in Dr. K.N. modi global school in modinagar.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Yoshi Company completed the following transactions and events involving its delivery trucks. 2012 Jan. 1 Paid $ 20,515 cash plus $ 1,485 in sales tax for a new delivery truck estimated to have a...

-

Yoshi Company completed the following transactions and events involving its delivery trucks. 2016 Jan. 1 Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estimated to have a...

-

The below table contains information related to 1,2,3 Monthly Stats including Active base (At beginning of each month), Sales, Chum and Activated from Domant Please calculate the following:...

-

Dickletton Attorneys' policy is to bank all receipts in its Trust bank account and at the end of each month the bookkeeper transfers the relevant funds due to Dickletton Attorneys from the trust to...

-

If an employer has a defined-benefit pension plan, what components would make up its net periodic pension cost?

-

Suppose that you observe a random sample of size n from a normally distributed population. If you are able to reject H0: = 0 in favor of a two-tailed alternative hypothesis at the 10% significance...

-

What are the likely advantages to Google, and to its staff, of these practices?

-

On January 1, 2017, Four Brothers Manufacturing borrowed $10 million from Guiffrie Bank by signing a three-year, 8.0% fixed-rate note. The note calls for interest to be paid annually on December 31....

-

Ninja Co. issued 14-year bonds a year ago at a coupon rate of 6.9%. The bonds make semiannual payments. If the YTM on the bonds is 5.2%, what is the current bond price in dollars? Assume a par value...

-

Mercury Delivery Service completed the following transactions involving equipment. Required Prepare journal entries to record these transactions and events. Year 1 Jan. 1 3 Paid $25,860 cash plus...

-

Champion Contractors completed the following transactions involving equipment. Required Prepare journal entries to record these transactions and events. Jan. 1 3 Paid $287,600 cash plus $11,500 in...

-

Which measurement method would be most appropriate for the following items: historical cost, fair value, lower of cost and net realizable value, net realizable value, or present value? 1. Inventory...

-

Canis Major Veterinary Supplies Inc. DuPont Analysis Ratios Value Correct/Incorrect Ratios Value Correct/Incorrect Profitability ratios Gross profit margin (%) 50.00 Correct Asset management ratio...

-

The entrance to Salt Lake City (elevation 3,075 ft at the point of crossing) is grade separated from interstate highway (elevation 3,050 ft at the point of crossing) and will have to be connected....

-

McKnight Handcraft is a manufacturer of picture frames for large retailers. Every picture frame passes through two departments: the assembly department and the finishing department. This problem...

-

A deep reinforced concrete member carries two members with factored loads as shown in Figure 2. Material properties: fy 400 MPa, f'e = 50 MPa. a) Sketch a feasible strut and tie model indicating the...

-

If triangles ABC and DFG are similar triangles and side DF = 218, what is the value of side DG?

-

The formula gives the monthly mortgage payment M on a home loan of P dollars at interest rate r, where n is the total number of payments (12 times the number of years). The cost of a house is...

-

In Exercises 105108, evaluate each expression without using a calculator. log(ln e)

-

Krug Company set the following standard unit costs for its single product. Direct materials (5 Ibs. @ $2 per Ib.) . . . . . . . . . . . . . . . . . . $10.00 Direct labor (0.3 hrs. @ $15 per hr.) . ....

-

Toronto Company's 2009 master budget included the following fixed budget report. It is based on an expected production and sales volume of 10,000 units. Required 1. Classify all items listed in the...

-

Refer to the information in Problem 8-2B. Toronto Company's actual income statement for 2009 follows. Required 1. Prepare a flexible budget performance report for 2009. Analysis Component 2. Analyze...

-

If the auditor believes that the financial statements prepared on the basis of the entity's income tax are not adequately titled, the auditor should : A)Issue a resignation of opinion. B)Explain the...

-

initial stock offering to the public. This REIT specializes in the acquisition and management of warehouses. Your firm, Blue Street Advisors, is an investment management company that is considering...

-

Question 3 You have been hired to run a pension fund for Mackay Inc, a small manufacturing firm. The firm currently has Gh5 million in the fund and expects to have cash inflows of $2 million a year...

Study smarter with the SolutionInn App