Carl Smith, after several years of employment in the television industry, resigned from his job and invested

Question:

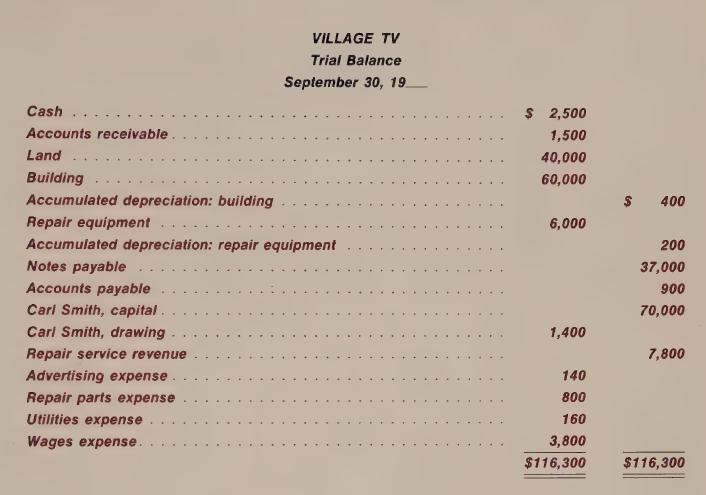

Carl Smith, after several years of employment in the television industry, resigned from his job and invested his time and money in a new business, Village TV, which opened its doors to customers for the first time on July 1. The accounting policy followed is to close the accounts and prepare financial statements at the end of each month. A trial balance prepared at September 30 is shown below. LO8

Depreciation of the building is based on an estimated useful life of 25 years. Useful life of the repair equipment is estimated to be 5 years.

Instructions a Prepare adjusting entries at September 30 to record depreciation for the month of September. (For the building, the calculation is: $60,000 25 years x rg-)

b Prepare an adjusted trial balance at September 30, 19 _ c Prepare an income statement for the month ended September 30, 19 _ , and a balance sheet in report form.

d If the company had overlooked the need for recording depreciation for September, what effect, if any, would this oversight have had upon the income statement and the balance sheet? (Use the terms “understated” and “overstated.”)

e Smith wants to compare the earnings from the business with what he earned when working as a salaried employee. Before starting his own business, Smith had earned a monthly salary of $1,700 and had on deposit in a bank the amount of $70, 000 which paid interest of $7,200 a year. Explain how the results of operations for September compare with the income (salary and interest) Smith would have received by continuing to work as a salaried employee and keeping the $70,000 savings in an interest-bearing bank account rather than investing it to start the business.

Step by Step Answer:

Accounting The Basis For Business Decisions

ISBN: 9780070415515

5th Edition

Authors: Robert F. Meigs, Walter B Meigs