John Ryan organized Freeway Express on June 1, 19 _ , to provide long-distance moving of household

Question:

John Ryan organized Freeway Express on June 1, 19 _ , to provide long-distance moving of household furniture. During June the following transactions occurred:

June 1 Ryan deposited $270,000 cash in a bank account in the name of the busi¬

ness, Freeway Express. LO8 June 3 Purchased land and building for a total price of $156,000, of which $60,000 was applicable to the land, and $96,000 to the building. Paid cash for full amount.

June 5 Purchased three trucks from Dawson Motors at a cost of $40,000 each. A cash down payment of $50,000 was made, the balance to be paid by July 22.

June 6 Purchased office equipment for cash, $4,800.

June 6 Moved furniture for Mr. and Mrs. David Hart from San Diego to Boston for $4,000. Collected $1,000 in cash, balance to be paid within 30 days (credit Moving Service Revenue).

June 11 Moved furniture for various clients for $9,800. Collected $4,400 in cash, balance to be paid within 30 days.

June 15 Paid salaries to employees for first half of the month, $5,000.

June 24 Moved furniture for various clients for a total of $6,480. Cash collected in full.

June 30 Salaries expense for the second half of month amounted to $5,800.

June 30 Received a gasoline bill for the month of June from Atlantic Oil Company in the amount of $6,200, to be paid before July 10.

June 30 Received bill of $300 for repair work on trucks during June by Century Motor Company.

June 30 The owner, John Ryan, withdrew $1,500 cash for personal use.

Ryan estimated a useful life of 20 years for the building, 4 years for the trucks, and 10 years for the office equipment.

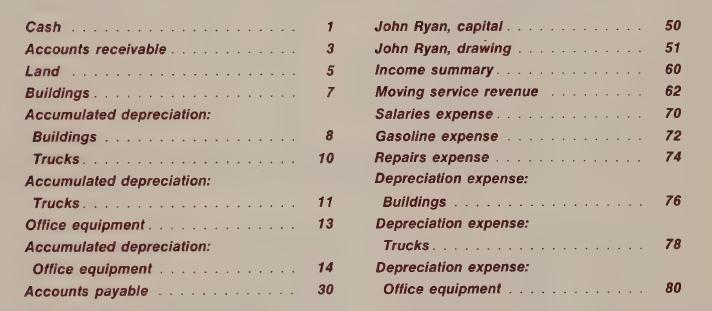

The account titles to be used and the account numbers are as follows:

Instructions a Prepare journal entries. (Number journal pages and enter the proper journal page number in the “Ref” column of the ledger accounts as each debit or credit is posted.)

b Post to ledger accounts. (As each journal entry is posted to the ledger, enter the identification number of the ledger account debited or credited in the “LP” col¬

umn of the journal. This will show that the amount has been posted and will provide a cross reference between journal and ledger.)

c Prepare a trial balance as of June 30, 19 -

d Prepare adjusting entries for depreciation during June and post to ledger ac¬

counts. (For example, the depreciation computation for buildings is: $96,000 cost -r- 20 years x ^-)

e Prepare an adjusted trial balance.

f Prepare an income statement for June, and a balance sheet at June 30, in report form.

g Prepare closing entries and post to ledger accounts.

h Prepare an after-closing trial balance.

Step by Step Answer:

Accounting The Basis For Business Decisions

ISBN: 9780070415515

5th Edition

Authors: Robert F. Meigs, Walter B Meigs