Miracle Tool, Inc., sells a single product (a combination screwdriver, pliers, hammer, and crescent wrench) exclusively through

Question:

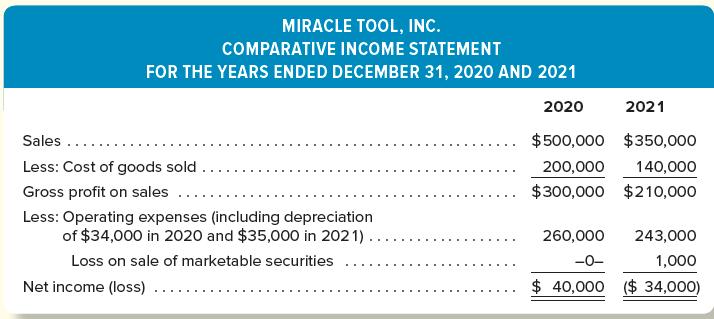

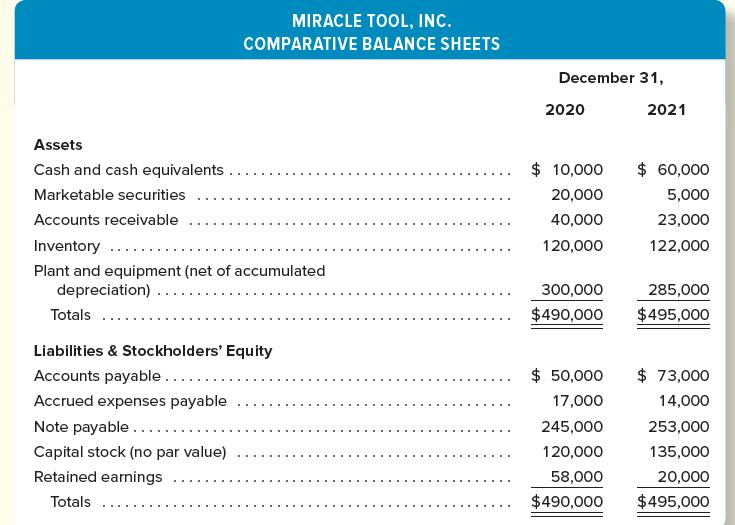

Miracle Tool, Inc., sells a single product (a combination screwdriver, pliers, hammer, and crescent wrench) exclusively through television advertising. The comparative income statements and balance sheets are for the past two years.

Additional Information

The following information regarding the company’s operations in 2021 is available from the company’s accounting records.

1. Early in the year the company declared and paid a $4,000 cash dividend.

2. During the year marketable securities costing $15,000 were sold for $14,000 cash, resulting in a $1,000 nonoperating loss.

3. The company purchased plant assets for $20,000, paying $2,000 in cash and issuing a note payable for the $18,000 balance.

4. During the year the company repaid a $10,000 note payable, but incurred an additional $18,000 in long-term debt as described in 3.

5. The owners invested $15,000 cash in the business as a condition of the new loans described in paragraph 4.

Instructions

a. Prepare a worksheet for a statement of cash flows, following the general format illustrated in Exhibit 13–7. (Note: If this problem is completed as a group assignment, each member of the group should be prepared to explain in class all entries in the worksheet, as well as the group’s conclusions in parts c, d, and e.)

b. Prepare a formal statement of cash flows for 2021, including a supplementary schedule of noncash investing and financing activities. (Use the format illustrated in Exhibit 13–8. Cash provided by operating activities is to be presented by the indirect method.)

c. Explain how Miracle Tool, Inc., achieved positive cash flows from operating activities, despite incurring a net loss for the year.

d. Does the company’s financial position appear to be improving or deteriorating? Explain.

e. Does Miracle Tool, Inc., appear to be a company whose operations are growing or contracting? Explain.

f. Assume that management agrees with your conclusions in parts c, d, and e. What decisions should be made and what actions (if any) should be taken? Explain.

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello