The following income statement was prepared by a new and inexperienced employee in the accounting department of

Question:

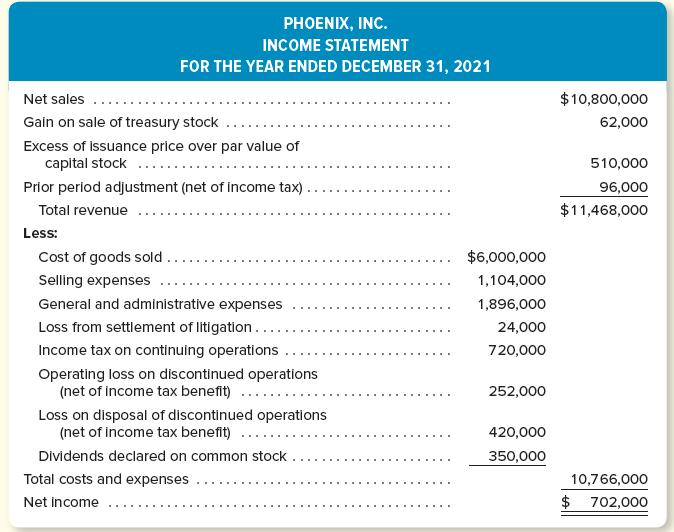

The following income statement was prepared by a new and inexperienced employee in the accounting department of Phoenix, Inc., a business organized as a corporation.

Instructions.

a. Prepare a corrected income statement for the year ended December 31, 2021, using the format illustrated in Exhibit 12–2. Include at the bottom of your income statement all appropriate earnings per share figures. Assume that throughout the year the company had outstanding a weighted average of 180,000 shares of a single class of capital stock.

b. Prepare a statement of retained earnings for 2021. (As originally reported, retained earnings at December 31, 2020, amounted to $2,175,000.)

c. What does the $62,000 “gain on sale of treasury stock” represent? How would you report this item in Phoenix’s financial statements at December 31, 2021?

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello