Timothy Property Management occupies a leased building on which it has paid rent in advance. Most of

Question:

Timothy Property Management occupies a leased building on which it has paid rent in advance. Most of the company’s revenue comes from managing office buildings and apartment buildings. Some clients pay Timothy in advance; these amounts are credited to Unearned Management Fees. Other clients pay only after services have been rendered for several months.

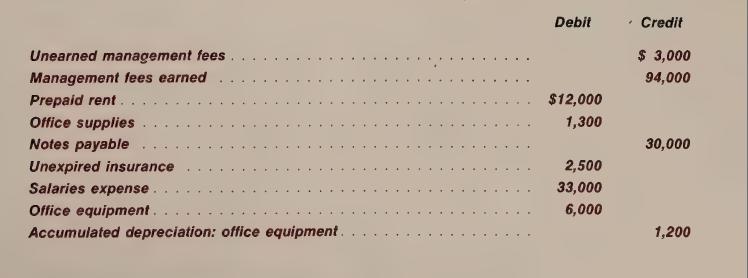

The company adjusts and closes its accounts at the end of each calendar year. At December 31, Year 5, selected ledger accounts before adjustment show the following balances: LO8

The accountant for Timothy Property Management compiled the following infor¬

mation as a basis for adjusting entries at December 31, Year 5.

(1) Unearned management fees at December 31 amounted to $1,800.

(2) Management fees of $2,500 had been earned but not yet recorded or billed to customers.

(3) Prepaid rent on the building at December 31 was $3,000.

(4) Office supplies on hand per count at December 31, $300.

(5) Accrued interest payable on notes payable at December 31, $1,500.

(6) Unexpired insurance at December 31, $500.

(7) Accrued salaries owed to employees at December 31, $1,600.

(8) Depreciation expense for the year was based on an estimated 10-year life for the office equipment.

Instructions a Prepare the adjusting entries needed at December 31.

b Which of the adjusting entries represent accruals of revenue or expense which will be followed by later cash collections or cash payments? List by identifying letter the adjusting entries of this type. Assuming that it is the company’s policy to use reversing entries, determine which of the adjusting entries in part a may be re¬ versed.

c Prepare the reversing entries.

Step by Step Answer:

Accounting The Basis For Business Decisions

ISBN: 9780070415515

5th Edition

Authors: Robert F. Meigs, Walter B Meigs