Question:

Use the Internet search engine of your choice and do a general search on the name of a company of interest to you (e.g., General Motors, Procter & Gamble, Coca-Cola, etc.). Explore the website of the company you choose and locate that company’s most recent financial statements. You may need to look under a category that provides general information about the company and/or investor information.

Instructions

a. Find and read the description of the company, including the type of business it is. Why is gaining an understanding of the industry and type of business an important starting point for financial statement analysis?

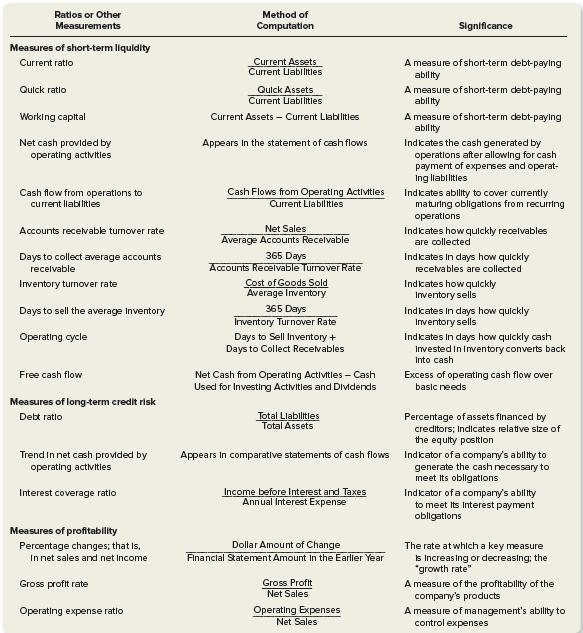

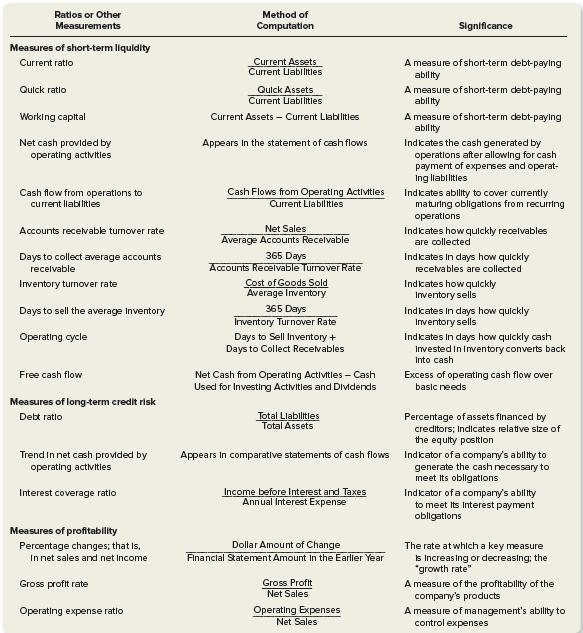

b. Locate the company’s most recent financial statements. Find the summary table of ratios in this chapter in Exhibit 14–26. Calculate three of the listed ratios under each of the following categories: “Measures of short-term liquidity” and “Measures of profitability.” Show your work in calculating these ratios. Write a brief statement describing what you have learned about your company’s liquidity and profitability.

c. Why do you think the Internet has become such a widely used source of financial information by investors and creditors?

Transcribed Image Text:

Ratios or Other

Measurements

Measures of short-term liquidity

Current ratio

Quick ratio

Working capital

Net cash provided by

operating activities

Cash flow from operations to

current liabilitles

Accounts receivable turnover rate

Days to collect average accounts

recelvable

Inventory turnover rate

Days to sell the average Inventory

Operating cycle

Free cash flow

Measures of long-term credit risk

Debt ratlo

Trend In net cash provided by

operating activities

Interest coverage ratio

Measures of profitability

Percentage changes; that is,

In net sales and net Income

Gross profit rate

Operating expense ratio

Method of

Computation

Current Assets

Current Liabilitles

Quick Assets

Current Labilities

Current Assets - Current Liabilities

Appears in the statement of cash flows

Cash Flows from Operating Activities

Current Liabilitles

Net Sales

Average Accounts Receivable

365 Days

Accounts Receivable Turnover Rate

Cost of Goods Sold

Average Inventory

365 Days

Inventory Turnover Rate

Days to Sell Inventory +

Days to Collect Receivables

Net Cash from Operating Activities - Cash

Used for Investing Activities and Dividends

Total Liabilities

Total Assets

Appears in comparative statements of cash flows

Income before Interest and Taxes

Annual Interest Expense

Dollar Amount of Change

Financial Statement Amount in the Earller Year

Gross Profit

Net Sales

Operating Expenses

Net Sales

Significance

A measure of short-term debt-paying

ability

A measure of short-term debt-paying

ability

A measure of short-term debt-paying

ability

Indicates the cash generated by

operations after allowing for cash

payment of expenses and operat-

Ing liabilitles

Indkates ability to cover currently

maturing obligations from recurring

operations

Indicates how quickly receivables

are collected

Indicates In days how quickly

receivables are collected

Indkates how quickly

Inventory sells

Indicates in days how quickly

Inventory sells

Indicates in days how quickly cash

Invested in Inventory converts back

Into cash

Excess of operating cash flow over

basic needs

Percentage of assets financed by

creditors; Indicates relative size of

the equity position

Indicator of a company's ability to

generate the cash necessary to

meet its obligations

Indicator of a company's ability

to meet its interest payment

obligations

The rate at which a key measure

Is Increasing or decreasing; the

"growth rate"

A measure of the profitability of the

company's products

A measure of management's ability to

control expenses