Boardwalk Web Design has just completed operations for the year ended December 31, 2025. This is the

Question:

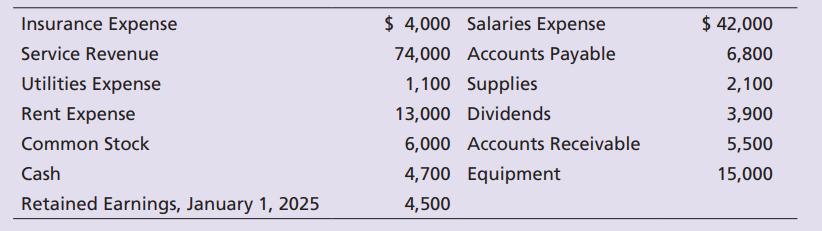

Boardwalk Web Design has just completed operations for the year ended December 31, 2025. This is the third year of operations for the company. The following data have been assembled for the business:

Prepare the income statement of Boardwalk Web Design for the year ended December 31, 2025.

Transcribed Image Text:

Insurance Expense Service Revenue Utilities Expense Rent Expense Common Stock Cash Retained Earnings, January 1, 2025 $4,000 Salaries Expense 74,000 Accounts Payable 1,100 Supplies 13,000 Dividends 6,000 Accounts Receivable 4,700 Equipment 4,500 $ 42,000 6,800 2,100 3,900 5,500 15,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

To prepare the income statement for Boardwalk Web Design for the year ended December 31 2025 w...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

Boardwalk Web Design has just completed operations for the year ended December 31, 2025. This is the third year of operations for the company. The following data have been assembled for the business:...

-

Boardwalk Web Design has just completed operations for the year ended December 31, 2025. This is the third year of operations for the company. The following data have been assembled for the business:...

-

Prepare the balance sheet of Centerpiece Arrangements as of December 31, 2018. Centerpiece Arrangements has just completed operations for the year ended December 31, 2018. This is the third year of...

-

When working as a tax professional, one issue that often arises is the need to provide difficult or disappointing guidance to a client. In the following example, determine the best course of action....

-

During Year 1, the organization received a gift of $80,000. The donor specified that this money be invested in government bonds with the interest to be used to pay the salaries of the organizations...

-

Write a query to display a brand name and the number of products of that brand that are in the database. Sort the output by the brandname. BINDER PRIME BUSTERS FORESTERS BEST HOME COMFORT LE MODE...

-

1 Calculate the gross profit in a recent year as a percentage of sales.

-

Lauren Moore, a professor in management science, is computing her final grades for her introductory management science class. The average final grade is a 63, with a standard deviation of 10....

-

om Home - Canva Citizenship and Im... Combined Person... NDL apter 2 Graded Homework Saved Help s 8 Speedy Auto Repairs uses a job-order costing system. The company's direct materials consist of...

-

Hildas Overhead Doors reports the following financial information: Requirements 1. Use the accounting equation to solve for the missing information. 2. Did Hildas Overhead Doors report net income or...

-

Many companies have been affected during the COVID-19 global pandemic. In particular, Starbucks Corporation (NASDAQ: SBUX) noted in its annual report, Our financial results have been and could...

-

Figure P2.29 shows position as a function of time for two cars traveling along the same highway. (a) At what instant(s) are the cars next to each other? (b) At what instant(s) are they traveling at...

-

Gary Tuttle has Citiwide Insurance with 100% coverage after a $25.00 copay on office visits. His services today include an office visit ($62.00), urinalysis with differential ($65.00) and a Treadmill...

-

The Elgin Golf Dutton Golf Merger Elgin Golf Inc. has been in merger talks with Dutton Golf Company for the past six months. After several rounds of negotiations, the offer under discussion is a...

-

f ( x ) = x ^ 3 - 3 x ^ 2 - 2 4 x + 5 6 find all critical numbers

-

Suppose a beam of electrons is aimed at two slits in a slide placed in front of a screen. After a short time, the screen looks like the one at the right. a. What evidence does the picture give that...

-

On January 1, Mitzu Company pays a lump-sum amount of $2,700,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an...

-

Rex Corporation (lessor) and Lee Company (lessee) agreed to a non-cancelable lease. The following information is available regarding the lease terms and the leased asset: a. Rex's cost of the leased...

-

For Problem estimate the change in y for the given change in x. y = f(x), f'(12) = 30, x increases from 12 to 12.2

-

Review your results from Short Exercise SC-8. Requirements 1. Total each column of the purchases journal. 2. Open the following four-column accounts in the accounts payable subsidiary ledger:...

-

A fire destroyed certain accounting records of Green Books. The controller, Marilyn Green, asks your help in reconstructing the records. All of the sales are on account, with credit terms of 2/10,...

-

Match the accounting terms on the left with the corresponding definitions on the right. 1. Prudence 2. Full disclosure 3. Moving average cost 4. FIFO 5. Consistency 6. Materiality 7. Specific...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App