Case 1 Jan Lorange manages Poppa Rollos Pizza, Inc., which has prospered during its second year of

Question:

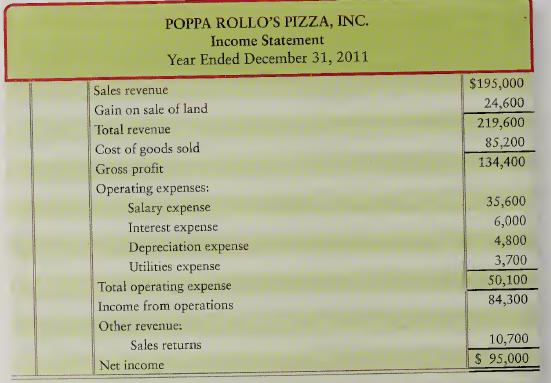

Case 1 Jan Lorange manages Poppa Rollo’s Pizza, Inc., which has prospered during its second year of operation. In order to help her decide whether to open another pizzeria, Lorange has prepared the current income statement of the business. Lorange read in an industry trade journal that a successful two-year-old pizzeria meets the following criteria.

a. Gross profit percentage is at least 60%

b. Net income is at least \($90,000\) Lorange believes the business meets both criteria. She intends to go ahead with the expansion plan and asks your advice on preparing the income statement m accordance with generally accepted accounting principles. When you point out that the statement includes errors, Lorange assures you that all amounts are correct. But some items are listed in the wrong place.

Requirement

1. Prepare a multi-step income statement and make a recommendation about whether Lorange should undertake the expansion.

Case 2. Bill Hildebrand and Melissa Nordhaus opened Party-Time T-Shirts to sell T-shirts for parties at their college. The company completed the first year of operations, and the owners are generally pleased with operating results, as shown by the following income statement:

Hildebrand and Nordhaus are considering how to expand the business. They each propose a way to increase profits to \($100,000\) during 2012.

a. Hildebrand believes they should advertise more heavily. He believes additional advertising costing \($20,000\) will increase net sales by 30% and leave general expense unchanged.

b. Nordhaus proposes selling higher-margin merchandise, such as party dresses. An importer can supply a minimum of 1,000 dresses for \($40\) each; Party-Time can mark these dresses up 100% and sell them for \($80.\) Nordhaus realizes they will have to advertise the new merchandise, and this advertising will cost \($5,000.\) Party-Time can expect to sell only 80% of these dresses during the coming year.

Requirement

1. Help Hildebrand and Nordhaus determine which plan to pursue. Prepare a single-step income statement for 2012 to show the expected net income under each plan.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9780135080191

2nd Edition

Authors: Charles T Horngren, Jr Walter T Harrison