Case 1. Lee Nicholas has been the principal stockholder and has operated World.com Advertising, Inc., since its

Question:

Case 1. Lee Nicholas has been the principal stockholder and has operated World.com Advertising, Inc., since its beginning 10 years ago. The company has prospered. Recently, Nicholas mentioned that he would sell the business for the right price.

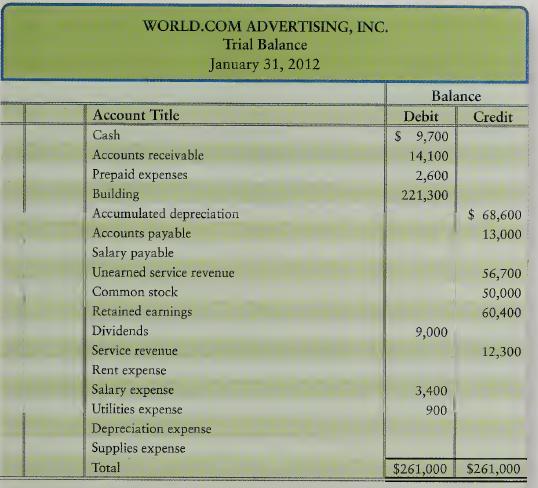

Assume that you are interested in buying World.com Advertising. You obtain the most recent monthly trial balance, which follows. Revenues and expenses vary little from month to month, and January is a typical month. Your investigation reveals that the trial balance does not include monthly revenues of \($3,800\) and expenses of \($1,100\). Also, if you were to buy World.com Advertising, you would hire a manager so you could devote your time to other duties. Assume that this person would require a monthly salary of $5,000.

Requirements 1. Assume that the most you would pay for the business is 20 times the monthly net income you could expect to earn from it. Compute this possible price.

2. Nicholas states that the least he will take for the business is an amount equal to the business’s stockholders’ equity balance on January 31. Compute this amount.

3. Under these conditions, how much should you offer Nicholas? Give your reason. (Challenge)

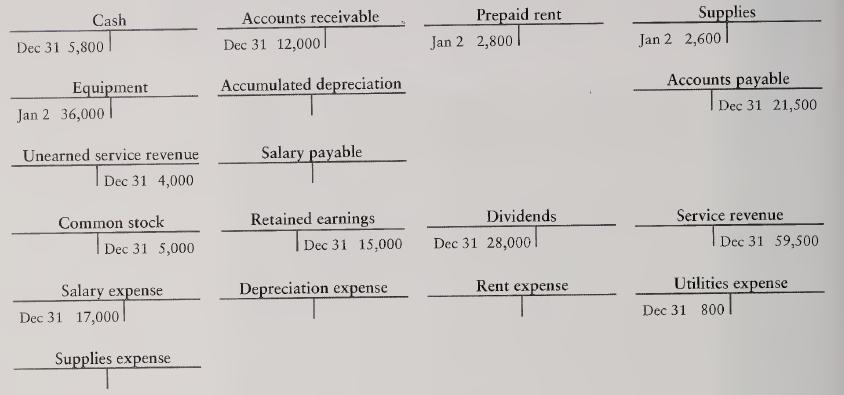

Case 2. One year ago, Tyler Stasney founded Swift Classified Ads. Stasney remembers that you took an accounting course while in college and comes to you for advice. He wishes to know how much net income his business earned during the past year in order to decide whether to keep the company going. His accounting records consist of the T-accounts from his ledger, which were prepared by an accountant who moved to another city. The ledger at December 31 follows. The accounts have not been adjusted.

Stasney indicates that at year-end, customers owe him \($1,600\) for accrued service revenue. These revenues have not been recorded. During the year, Stasney collected \($4,000\) service revenue in advance from customers, but he earned only \($900\) of that amount. Rent expense for the year was \($2,400\), and he used up \($1,700\) of the supplies. Stasney determines that depreciation on his equipment employee \($1,200\) accrued salary.

Requirement 1.Help Stasney compute his net income for the year. Advise him whether to continue operating Swift Classified Ads.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9780135080191

2nd Edition

Authors: Charles T Horngren, Jr Walter T Harrison