F. Scott designs and manufactures fashionable women's clothing. For the coming year, the company has scheduled production

Question:

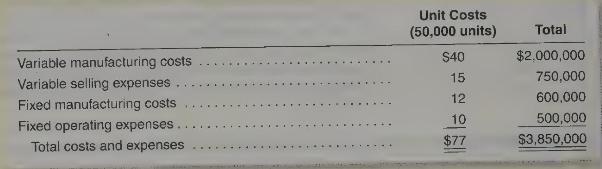

F. Scott designs and manufactures fashionable women's clothing. For the coming year, the company has scheduled production of 50,000 silk skirts. Budgeted costs for this product are as follows:

The management of F. Scott is considering a special order from Discount Fashions for an additional 15,000 skirts. These skirts would carry the Discount Fashions label, rather than the F. Scott label. In all other respects, they would be identical to the regular F. Scott skirts.

Although F. Scott regularly sells its skirts to retail stores at a price of \(\$ 180\) each, Discount Fashions has offered to pay only \(\$ 60\) per skirt. However, because no sales commissions would be involved with this special order, F. Scott will incur variable selling expenses of only \(\$ 5\) per unit on these sales, rather than the \(\$ 15\) it normally incurs. Accepting the order would cause no change in the company's fixed manufacturing costs or fixed operating costs. F. Scott has enough plant capacity to produce 70,000 skirts per year.

Instructions

a. Using incremental revenue and incremental costs, compute the expected effect of accepting this special order on F. Scott's operating income.

b. Briefly discuss any other factors that you believe F. Scott's management should consider in deciding whether to accept the special order. Include nonfinancial as well as financial considerations.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 12

14th International Edition

Authors: Jan R. Williams, Joseph V. Carcello, Mark S. Bettner, Sue Haka, Susan F. Haka