Lucas Tax Consultancy gathered the following information for the adjusting entries on April 30, 2024: a. Accrued

Question:

Lucas Tax Consultancy gathered the following information for the adjusting entries on April 30, 2024:

a. Accrued service revenue, $900.

b. Earned $800 of the service revenue collected in advance.

c. The unadjusted balance of the Office Supplies account is $600. Office supplies used, $200.

d. Depreciation expense on equipment, $400; furniture, $250.

e. Accrued expense for employee’s salary, $800.

f. The company paid its rent of $100 for the month of October on November 12.

g. The company paid local taxes of $240 for the month of November on October 27. The company recorded a $240 debit to Local Tax Expense and a $240 credit to Cash.

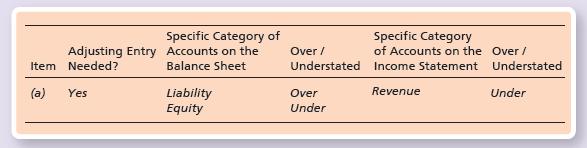

Journalize and post the adjusting entries needed on April 30, 2024. Indicate what would be the impact on Lucas Tax Consultancy’s financial statements if the adjusting entries are not made by specifying category or categories of accounts that are overstated or understated. Use the following table as a guide. Item a is completed as an example:

Step by Step Answer:

Horngrens Financial & Managerial Accounting

ISBN: 9780136516255

7th Edition

Authors: Tracie Miller Nobles, Brenda Mattison