Northwest Records is considering the purchase of Seattle Sound, Inc., a small company that promotes and manages

Question:

Northwest Records is considering the purchase of Seattle Sound, Inc., a small company that promotes and manages “industrial rock” bands. The terms of the agreement require that Northwest pay the current owners of Seattle Sound $600,000 to purchase the company. Northwest executives estimate that the investment will generate annual net cash flows of $250,000. They do not feel, however, that demand for grunge music will extend beyond four years. Therefore, they plan to liquidate the entire investment in Seattle Sound at its projected book value of $40,000 at the end of the fourth year. Due to the high risk associated with this venture, Northwest requires a minimum rate of return of 20 percent.

a. Compute the payback period for Northwest’s proposed investment in Seattle Sound.

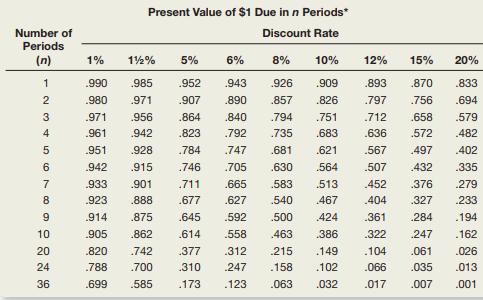

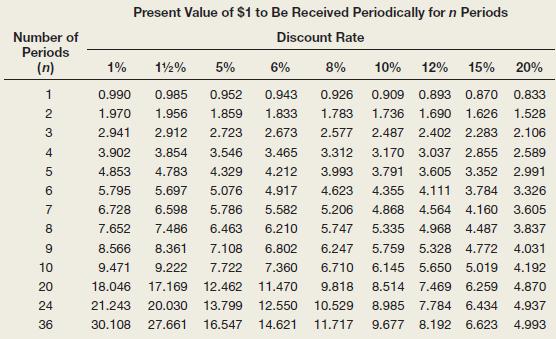

b. Compute the net present value of the Seattle Sound proposal, using the tables in Exhibits 26–3 and 26–4.

c. What nonfinancial factors would you recommend that Northwest executives take into consideration regarding this proposal?

Exhibit 26-3:

Exhibit 26-4:

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078025778

17th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello