Rusek Corp. earned net income of $118,000 and paid the minimum dividend to preferred stockholders for 2025.

Question:

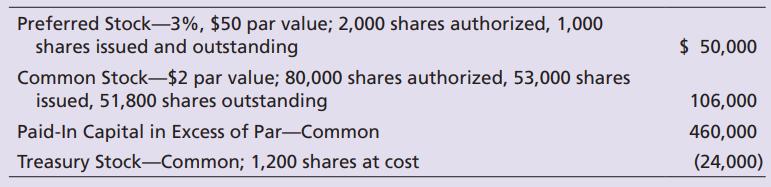

Rusek Corp. earned net income of $118,000 and paid the minimum dividend to preferred stockholders for 2025. Assume that there are no changes in common shares outstanding during 2025. Rusek Corp.’s books include the following figures:

Requirements

1. Compute Rusek Corp.’s EPS for the year.

2. Assume Rusek Corp.’s market price of a share of common stock is $8 per share. Compute Rusek Corp.’s price/earnings ratio.

Transcribed Image Text:

Preferred Stock-3%, $50 par value; 2,000 shares authorized, 1,000 shares issued and outstanding Common Stock-$2 par value; 80,000 shares authorized, 53,000 shares issued, 51,800 shares outstanding Paid-In Capital in Excess of Par-Common Treasury Stock-Common; 1,200 shares at cost $ 50,000 106,000 460,000 (24,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

ANSWER 1 To compute Rusek Corps EPS Earnings Per Share for the year Step 1 Calculate the weighted av...View the full answer

Answered By

Ma Kristhia Mae Fuerte

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

Altar Corp. earned net income of $ 118,000 and paid the minimum dividend to preferred stockholders for 2014. Assume that there are no changes in common shares outstanding. Altars books include the...

-

Kevin is an employee of elite Engravings a family owned and operated firm. His relative, Sheronda, asks him to postpone payroll processing due to an urgent family issue. Which ethical principle might...

-

Rocket Corp. earned net income of $153,040 and paid the minimum dividend to preferred stockholders for 2024. Assume that there are no changes in common shares outstanding during 2024. Rockets books...

-

Which of the following statements are true about REST? Pick ONE OR MORE options Logical URLs should be used instead of physical URLS Adal URLs must always be used in REST response A paging technique...

-

What ethical problems do you see in conducting experiments with human subjects?

-

Why do scientists think that RNA silencing is an evolutionarily conserved process?

-

Data for Warner Company are presented in P12-7A. Further analysis reveals the following. LO11 1. Accounts payable pertain to merchandise suppliers. 2. All operating expenses except for depreciation...

-

Danna Martin, president of Mays Electronics, was concerned about the end-of-the year marketing report that she had just received. According to Larry Savage, marketing manager, a price decrease for...

-

A CPA firm that provides audit services for a client generally cannot provide expert witness services for the client because the firm will lack independence. True False

-

Toledo Custom Manufacturing (TCM) makes machined steel parts to customer specification. They have a variety of machines that can hold tight tolerances. In this case they have just received an order...

-

Isbell, Inc.s accounting records include the following for 2025: Assume Isbell, Inc.s income tax rate is 21%. Prepare Isbell, Inc.s multi-step income statement for the year ending December 31, 2025....

-

Alford Manufacturing Co. completed the following transactions during 2025: Requirements 1. Record the transactions in Alford Manufacturing Co.s general journal. 2. Prepare the Alford Manufacturing...

-

Go to the Investment Company Institute website and look up the most recent data on the asset values and number of short-term and long-term mutual funds using the following steps. The website is...

-

How would you explain the following code in plain English? boxplot(age ~ gender, data = donors) Question 8 options: Make a boxplot comparing gender grouped by age, using the donors dataset Make two...

-

Vision Consulting Inc. began operations on January 1, 2019. Its adjusted trial balance at December 31, 2020 and 2021 is shown below. Other information regarding Vision Consulting Inc. and its...

-

A Jeans maker is designing a new line of jeans called Slams. Slams will sell for $290 per unit and cost $182.70 per unit In variable costs to make. Fixed costs total $68,500. (Round your answers to 2...

-

NAME: Week Two Define Claim in your own words Explain the difference between a discussion and an argument. Summarize the characteristics of a claim (Listing is not summarizing) Define Status Quo in...

-

1.How do you think major stores such as Walmart will change in the future under this new retail renaissance? 2.What are some changes that you would suggest in traditional retail stores to attract...

-

Suppose that a basketball player can score on a particular shot with probability .3. Use the central limit theorem to find the approximate distribution of S, the number of successes out of 25...

-

Ashlee, Hiroki, Kate, and Albee LLC each own a 25 percent interest in Tally Industries LLC, which generates annual gross receipts of over $10 million. Ashlee, Hiroki, and Kate manage the business,...

-

The adjusted trial balance of Sylvias Music Company at June 30, 2024, follows: Requirements 1. Prepare Sylvias multi-step income statement for the year ended June 30, 2024. 2. Journalize Sylvias...

-

The adjusted trial balance of Sylvias Music Company at June 30, 2024, follows: Requirements 1. Prepare Sylvias multi-step income statement for the year ended June 30, 2024. 2. Journalize Sylvias...

-

The unadjusted trial balance for Tiger Electronics Company at March 31, 2024, follows: Requirements 1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $500. b....

-

Estimate the intrinsic value of the stock company ABC. Dividends were just paid at $8 per share and are expected to grow by 5%. You require 20% on this stock given its volatile characteristics. If...

-

Crane, Inc., a resort management company, is refurbishing one of its hotels at a cost of $6,794,207. Management expects that this will lead to additional cash flows of $1,560,000 for the next six...

-

Match each of the following transactions with the applicable internal control principle that is being violated

Study smarter with the SolutionInn App