The August 31 bank statement of Well Healthcare has just arrived from United Bank. To prepare the

Question:

The August 31 bank statement of Well Healthcare has just arrived from United Bank.

To prepare the bank reconciliation, you gather the following data:

a. The August 31 bank balance is $4,540.

b. The bank statement includes two charges for NSF checks from customers. One is for $380 (#1), and the other is for $180 (#2).

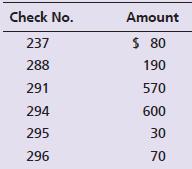

c. The following Well Healthcare checks are outstanding at August 31

d. Well collects from a few customers by EFT. The August bank statement lists a $1,200 EFT deposit for a collection on account.

e. The bank statement includes two special deposits that Well hasn’t recorded yet:

$800 for dividend revenue, and $120 for the interest revenue Well earned on its bank balance during August.

f. The bank statement lists a $50 subtraction for the bank service charge.

g. On August 31, the Well treasurer deposited $260, but this deposit does not appear on the bank statement.

h. The bank statement includes a $1,050 deduction for a check drawn by Multi-State Freight Company. Well notified the bank of this bank error.

i. Well’s Cash account shows a balance of $2,800 on August 31.

Requirements

1. Prepare the bank reconciliation for Well Healthcare at August 31, 2024.

2. Journalize any required entries from the bank reconciliation. Include an explanation for each entry

Step by Step Answer:

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9781292412320

7th Global Edition

Authors: Tracie Miller-Nobles, Brenda Mattison, Ella Mae Matsumura