This problem continues the Crystal Clear Cleaning practice set begun in Chapter F:2 and continued through Chapters

Question:

This problem continues the Crystal Clear Cleaning practice set begun in Chapter F:2 and continued through Chapters F:3 and F:4.

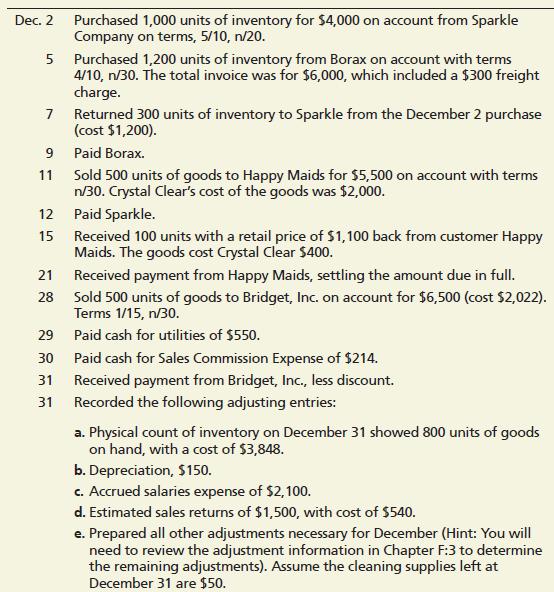

Crystal Clear Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Crystal Clear uses the perpetual inventory system. During December 2024, Crystal Clear completed the following transactions

Requirements

1. Open the following T-accounts in the ledger: Cash, $51,650; Accounts Receivable, $4,000; Merchandise Inventory, $0; Estimated Returns Inventory, $0; Cleaning Supplies, $50; Prepaid Rent, $3,000; Prepaid Insurance, $4,400; Equipment, $5,400;

Truck, $3,000; Accumulated Depreciation, $150; Accounts Payable, $1,245; Salaries Payable, $0; Interest Payable, $59; Refunds Payable, $0; Unearned Revenue, $14,375; Notes Payable, $36,000; Common Stock, $18,000; Retained Earnings, $1,671; Income Summary, $0; Dividends, $0; Service Revenue, $0; Sales Revenue, $0; Cost of Goods Sold, $0; Salaries Expense, $0; Sales Commission Expense, $0;

Utilities Expense, $0; Depreciation Expense, $0; Rent Expense, $0; Insurance Expense, $0; Interest Expense, $0.

2. Journalize and post the December transactions. Omit explanations. Compute each account balance, and denote the balance as Balance. Identify each accounts payable and accounts receivable with the vendor or customer name.

3. Journalize and post the adjusting entries. Omit explanations. Denote each adjusting amount as Adj. Compute each account balance, and denote the balance as Balance.

After posting all adjusting entries, prove the equality of debits and credits in the ledger by preparing an adjusted trial balance.

4. Prepare the single step income statement and statement of retained earnings for the month ended December 31, 2024. Also prepare a classified balance sheet at December 31, 2024. Assume the note payable is long-term.

5. Compute the gross profit percentage for December for the company

Step by Step Answer:

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9781292412320

7th Global Edition

Authors: Tracie Miller-Nobles, Brenda Mattison, Ella Mae Matsumura