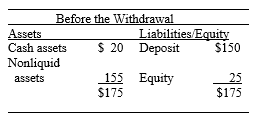

Consider the simple FI balance sheet below (in millions of dollars). Suppose that depositors unexpectedly withdraw $50

Question:

Consider the simple FI balance sheet below (in millions of dollars).

Suppose that depositors unexpectedly withdraw $50 million in deposits and the FI receives no new deposits to replace them. Assume that the FI cannot borrow any more funds in the short-term money markets, and because it cannot wait to get better prices for its assets in the future (as it needs the cash now to meet immediate depositor withdrawals), the FI has to sell any nonliquid assets at 75 cents on the dollar. Show the FI’s balance sheet after adjustments are made for the $50 million of deposit withdrawals.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Institutions Management A Risk Management Approach

ISBN: 978-1259717772

9th edition

Authors: Anthony Saunders, Marcia Millon Cornett

Question Posted: