Suppose that a U.S. FI has the following assets and liabilities: The promised one-year U.S. CD rate

Question:

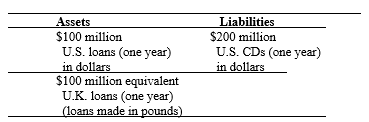

Suppose that a U.S. FI has the following assets and liabilities:

The promised one-year U.S. CD rate is 5 percent, to be paid in dollars at the end of the year; the one-year, default risk–free loans are yielding 6 percent in the United States; and one-year, default risk–free loans are yielding 12 percent in the United Kingdom. The exchange rate of dollars for pounds at the beginning of the year is $1.60/£1.

a. Calculate the dollar proceeds from the UK investment at the end of the year, the return on the FI’s investment portfolio, and the net return for the FI if the spot foreign exchange rate has not changed over the year.

b. Calculate the dollar proceeds from the UK investment at the end of the year, the return on the FI’s investment portfolio, and the net return for the FI if the spot foreign exchange rate falls to $1.45/£1 over the year.

c. Calculate the dollar proceeds from the UK investment at the end of the year, the return on the FI’s investment portfolio, and the net return for the FI if the spot foreign exchange rate rises to $1.70/£1 over the year.

Exchange RateThe value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 978-1259717772

9th edition

Authors: Anthony Saunders, Marcia Millon Cornett