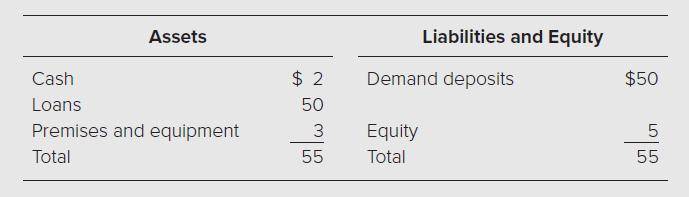

The following is the balance sheet of a DI (in millions): The assetliability management committee has estimated

Question:

The following is the balance sheet of a DI (in millions):

The asset–liability management committee has estimated that the loans, whose average interest rate is 6 percent and whose average life is three years, will have to be discounted at 10 percent if they are to be sold in less than two days. If they can be sold in four days, they will have to be discounted at 8 percent. If they can be sold later than a week, the DI will receive the full market value. Loans are not amortized; that is, the principal is paid at maturity.

a. What will be the price received by the DI for the loans if they have to be sold in two days? In four days?

b. In a crisis, if depositors all demand payment on the first day, what amount will they receive? What will they receive if they demand to be paid within four days? Assume no deposit insurance.

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 9781266138225

11th International Edition

Authors: Anthony Saunders, Marcia Millon Cornett, Otgo Erhemjamts